10 week money bounce back challenge

January 24th 2020 | Categories: Budgeting & Goals |

READY FOR A FINANCIAL BOUNCE BACK?

Saving isn’t always easy, but it is essential in reaching long term financial goals such as buying a house or preparing for retirement. Whether you went a bit silly over the festive season or are simply lacking some motivation and ready to start prioritising your financial health again, this challenge is for you! Consider this your financial Bootcamp, where we aim to grow your bank account instead of shrinking your waistline.

Throughout the 10 week challenge, we will help you not only bounce back financially by saving $1000 over 10 weeks but also prepare you to achieve your financial goals for the long term. You will also get invaluable free printable resources along the way.

Ready now? Join here!

Understand how a financial adviser can support you with your need for financial security. Get in touch.

[ninja_form id=37]

So, what does the challenge involve?

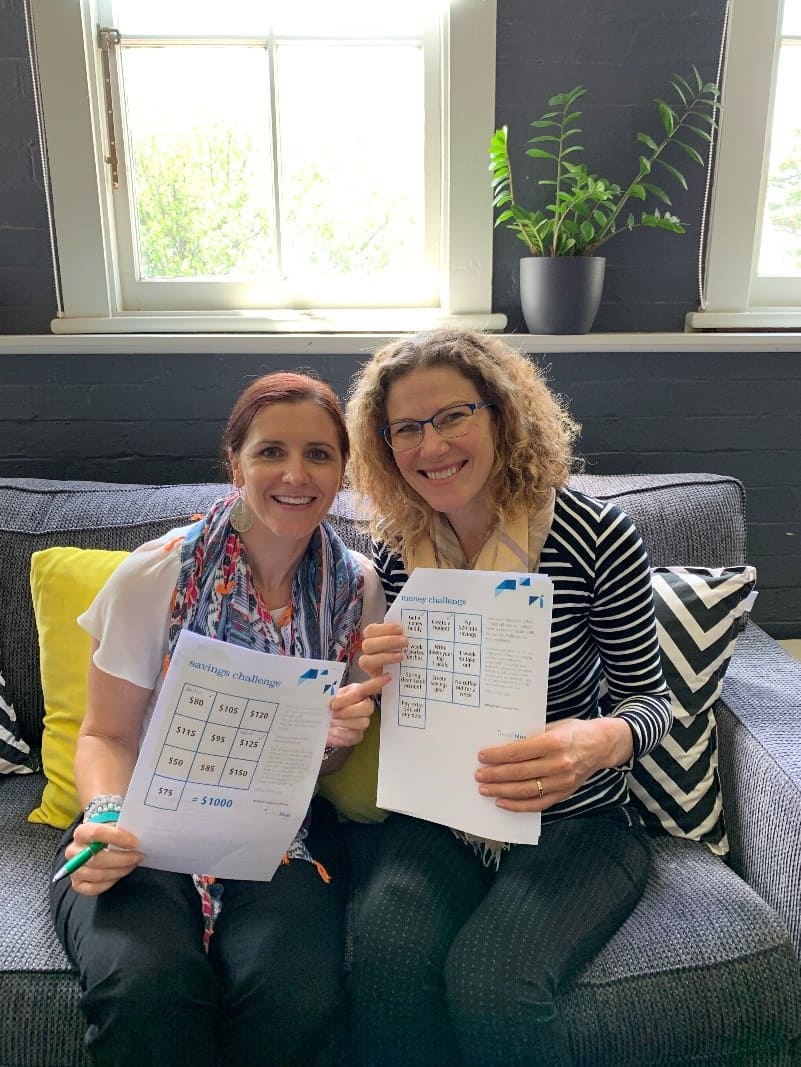

The challenge includes two main challenge sheets. The savings sheet requires you to choose an amount from the sheet to put towards savings each week and at the end of the challenge, you will have $1,000 saved. The money challenge sheet has different challenges to try each week to help you save better and set up fundamentals of saving that will help you in the long term such as creating a budget.

“I’m excited about starting the Challenge and re-building my savings account. It’s a lot of fun doing the activities with a Buddy and we laugh about our spending quirks.” Fiona

“Saving $1000 will enable me to start my plan to spend next Christmas with my family in Perth, something I haven’t done for three years. The budgeting tool is motivating me to create better habits for my spending in the long-term.” Nicole

10-Week Outline

For each of the 10 weeks, a new activity is emailed containing various resources and a challenge aimed to get you a step closer towards achieving your financial goals.

WEEK 1 – Creating Your 2020 Budget

WEEK 2 – Spring Clean your Bank Accounts

WEEK 3 – Your Super and Savings Benchmark

WEEK 4 – Get Savvy

WEEK 5 – Review Week

WEEK 6 – Your Dreams and Goals

WEEK 7 – Debt, Savings and Buy Now, Pay Later

WEEK 8 – Treating Yourself on a Budget

WEEK 9 – Ways to Grow and Invest Your Money

WEEK 10 – Financial Health Check

Come and join us on the challenge! You can join here.

What’s included

Resources included with the Challenge are:

- Two challenge sheets

- Free budgeting tool

- Complimentary initial consultation

- Financial Health Check

- Email support

- A weekly email with more resources

- Strategies for doing more with your savings

Joining the Challenge is free, take charge of your financial plan this year, see how much you can save, understand your financial health and set your goals and dreams for the future.

Achieving your goals is easier when you have a Money Buddy

Ever noticed it’s easier to turn up to the gym if a friend is meeting you there and holding you accountable? Introducing the Money Buddy! By sharing your goals with a friend, Introducing the Money Buddy! By sharing your goals with a friend, you are more likely to actually achieve them which is why we encourage all participants to find a buddy to do the 10-week challenge with. You can send them the subscription link here.

Group support

We also have a closed Facebook group where we share extra tips and support. We also encourage you to share your progress or ask questions to the page. You will also find all pdf resources here under the files tab.

You can join our group here.

Take on the challenge!

Feeling motivated to become a savvy saver? Join our free 10-week financial bounce back challenge, where we provide free budgeting resources, share all our best tips and give a weekly activity to make your savings plan for 2020 the best yet!

Feeling motivated to become a Savvy Saver and feel like you need more? Our Advisers commonly help Clients with budgeting and saving, alongside more complicated financial matters such as investing and debt consolidation. Reach out to us today or ask us a question. We’re here to help you to achieve your best possible life.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Budgeting & Goals