Ask an Adviser – What is Wealth Protection and is it really necessary?

February 4th 2022 | Categories: Insurance | Ask An Adviser |

We’ve all come to appreciate, particularly over the past two years or so, that life doesn’t always go according to plan, which is why you may want to consider taking a proactive approach to protecting your assets and reducing your risk exposure.

Financial Adviser Adam Winstone believes that implementing strategies to protect the wealth our clients have worked so hard to achieve is one of the most important components of financial planning.

Below, Adam shares his insights on Wealth Protection.

Q. What is Wealth Protection?

Wealth protection describes the strategies that help protect individuals and families in case of unexpected health or life event.

We work with our clients on the positive aspects of financial planning but also introduce the possibility of unexpected challenges arising along the way such as illness, loss of employment, accident or injury. We consider the potential impact of such events on a client’s income and family.

We want to ensure that there’s some kind of financial reserve built up so that they can still achieve their all-important goals, even in the event of difficult circumstances.

You can read more about our approach in our ‘wealth protection philosophy’

Q. Should everyone consider Wealth Protection?

I believe it should be thought about, yes. We’re all working hard every day to try and further ourselves along, to ensure our family’s future is secure and to get closer to retirement and in light of that, it’s an important consideration.

Q. How do people establish Wealth Protection?

There are two ways of doing so. Firstly, through existing investments and secondly, through insurance. Both are equally important.

Some people can create wealth protection through their own assets. These are clients who have cash in reserve. They may own their home, own an investment property or have a share portfolio and because of that, are in a position to cover short-term periods if their income is affected.

However, many people aren’t in such a position which is where personal insurances such as life insurance, TPD cover (Total and Permanent Disability) and trauma insurance are crucial.

Trauma insurance (also known as ‘critical illness’ or ‘recovery insurance’) is an important conversation to have because this has one of the highest rates of claims and includes cancer, stoke, heart attacks, head injuries, brain injuries and more. Statistically, one in three people will have one of these trauma related events in their lifetime and a payout can be hugely beneficial, not just for the person who is unwell or injured but for their partner and family.

One example that comes to mind is that of a local family where the wife had cancer, and the lump sum trauma insurance payment received was used to cover the husband’s income. He could then take time off work to better support his wife and family. A very important aspect for him was being able to be with his wife throughout her medical appointments and regular treatment. The payout allowed for far greater flexibility with his work even though he was not the one who was unwell.

Q. Is Wealth Protection something only a financial expert can help with?

Not necessarily. You could do it yourself, but it’s rather a complex area and it’s about getting a number of different things right. It’s fair to say that not all strategies and insurances are created equal, so wealth protection needs to be considered in a very personal capacity.

Q. Does someone’s age and stage in life impact the advice you provide?

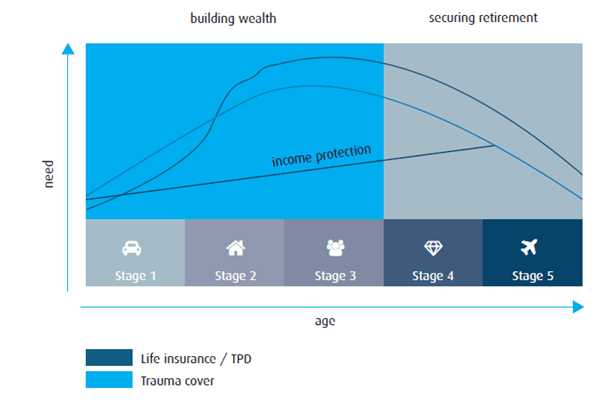

Absolutely. Where someone is at in life has a massive impact on the advice we give.

For example, life or trauma insurance doesn’t have the same priority for younger people as it does for those clients with a partner, mortgage and family.

As we get older, we’re in a better position to build up our wealth so there’s less reliance on insurance policies. Until the point of financial security though, insurance cover helps protect you.

Our job is to look closely at where clients are at and get the balances right.

Q. We seem to have insurance cover for everything these days. Is it really necessary?

Most of us do indeed have numerous insurance policies in place (car, home, contents, pet, health – the list goes on) but it’s important to remember that many things we have insurance cover for are replaceable whereas our income is not.

A certain situation that comes to mind is that of a Hobart-based client who was undergoing cancer treatment when we met with him at home. He was fortunate in being able to continue to work in some capacity and was very well supported by his employer during his cancer treatment, but a lump sum income protection payment covered the equivalent of six months of full-time wages which was a great win. It took off a lot of pressure during a very daunting time for our client.

Imagine finding yourself in a position where you’re unable to work for a time. Should you be the family’s primary breadwinner, the importance of income protection becomes immeasurable.

Q. Lastly, a potential client is seeking information about financial planning and Wealth Protection. What’s the next step?

The best thing is to arrange a complimentary meeting to ascertain how we can be of assistance. I’d start by doing a thorough and very personalised needs analysis. This then helps me to create a tailor-made, strategy-based approach for someone’s financial future.

I like to take a goals-based approach with my clients. We discuss those big dreams and any particular goals they’re keen to achieve. And when it comes to wealth protection specifically, our aim is to ensure that a client can still achieve those goals even in the event of a significant health incident.

Adam Winstone

Financial Planner

Connect with Adam Winstone on LinkedIn

Keen to start living your best life? We welcome you to arrange a complimentary consultation to ascertain how we can be of assistance.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Insurance, Ask An Adviser