Ask an Adviser – Your dream retirement

November 17th 2020 | Categories: Ask An Adviser | Retirement | Financial Planning |

So, you’re starting to seriously think about retirement and are asking such questions as ‘when can I retire?’ and ‘how much do I need to retire?’. These are all common queries, especially for those transitioning into retirement.

In order to help answer these questions some key areas that need to be considered including reviewing your savings, investments and superannuation, as well as identifying where you want to live and where you can source an income.

So, to help you get a clearer picture on your retirement dreams and goals, we are joined by our Melbourne-based financial planner, Lazarus Papadopoulos to share his most frequently asked questions and tips on how you can plan your best life in retirement.

Q. How do you know if your retirement savings are on track?

Exactly how much you will need for retirement will vary from person to person. It will depend on what kind of lifestyle you desire, whether you are a couple or single and so on.

To get a clear idea of how much you will need to retire, it’s important to spend some time identifying what exactly you want to achieve and what your dreams and goals are. Perhaps you wish to travel, buy a caravan or move closer to your family.

You then need to create a budget to get a clear picture of your living costs and expenses.

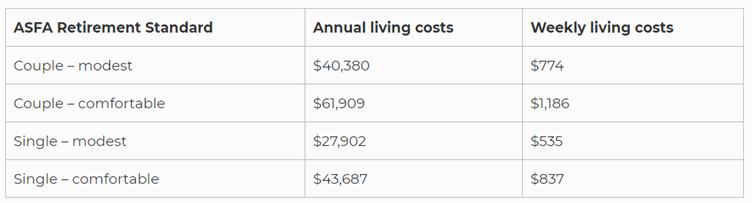

To give you an idea the graph below shows the average retirement standard according to the Association of Superannuation Funds of Australia’s (ASFA) report as of June 2020.

By multiplying out ASFA’s Retirement Standard by the average life expectancy, we reach the following:

- A single person needs $861,220 for 20 years of comfortable retirement from 65 to 85.

- A couple needs $1,230,400 for 20 years of comfortable retirement from 65 to 85.

Once you understand your goals and expenses it will be easier to identify how much you need saved or income coming in to retire.

Your portfolio may be built up in a combination of superannuation, savings or investments. You may also have income coming in from dividends, investment properties or be eligible for the pension.

You can use our super simulator to see how much super you could have, how long it will last and what lifestyle you can afford.

You may be interested in our articles:

- 5 tips to help you save for retirement

- What do you want your retirement to look like

- How do you know if you’re ready for retirement

If you would like to discuss your options and how you might manage it from a financial perspective, please get in touch.

[ninja_form id=37]

Q. I’m worried I don’t have enough for retirement, what should I do?

Fears around retirement savings are quite common, I’ve helped many clients over the years strategise their retirement plan and help them be in a better position to retire.

When looking into your entire financial picture we might find things like lost super and underperforming investments, as well as, identify how we can reduce your current expenses and consolidate debt – these can all help boost your retirement savings at the end of the day.

There are other options that can help with extra funding too such as downsizing your home or building investments outside of super.

The sooner you see a financial planner the sooner we can help you understand your complete financial picture and create a plan to get you on track to retire. In some instances, we can help clients retire years before they imagined.

For instance, I’ve had clients who’ve had lost super, unclaimed insurance they were unaware of (built into their super policy), to those who simply needed to stick to a budget – in these cases they were able to achieve their retirement goals.

You may be interested in our client story “shaping physically and financially for a dream retirement”.

Q. How does tax change in retirement?

There are two stages for retirement: transitioning into retirement known as ‘preservation age’ (55-59 age group) and retirement age (60+ age group). And, how you are taxed varies depending on which of these you fall into.

Both pension payments and access to superannuation are tax-free. For those aged 55-59 years, a marginal tax rate of 15 per cent applies to pension payments. Also, access to superannuation is tax-free if withdrawals are below the low rate cap of $205,000, withdrawals above this amount will be taxed at a 17 per cent marginal rate.

You may be interested in our article “strategies to reduce tax in retirement”.

Q. How can I find lost super?

There are a few ways you may be able to find lost super. The easiest way is through MyGov and linking your account with the ATO. There is a search line or paper form which you can access here. A financial planner will also be able to assist you with this as part of your financial plan.

Q. What should I consider before retiring?

Here are a few suggestions on what to consider before retiring:

- Review all debts, assets, savings and investment performances and expenses.

- Consider what you want your dream retirement to look like.

- Check your super balance, look for lost super and consolidate if you have more than one account.

- Contact a financial planner as they may be able to make a significant difference to your financial position, and ultimately help you achieve your retirement dreams and goals sooner.

- Ensure you have a Will in place and have nominated your beneficiaries and

Here are a few resources which may assist you to plan your dream retirement:

Lazarus Papadopoulos

Financial Adviser

Connect with Lazarus on LinkedIn

Speak with Lazarus or one of our trusted and accredited financial advisers today on how we can help you live your dream life in retirement.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Ask An Adviser, Retirement, Financial Planning