Matters of the Heart

December 1st 2017

The professional relationship between Central Coast based financial planner, Steve Fort and the Sandersons goes back to 2006. At the time, Craig and Sam were looking to move out of Sydney for lifestyle reasons and with plans to start a family also on the horizon, the couple were keen to get sound financial advice. Fast forward to 2017 and despite residing in different states, Steve remains the couple’s trusted adviser.

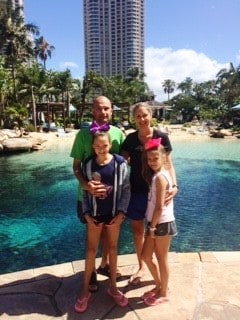

The Sandersons have long called Queensland’s Bribie Island home and are now parents to two daughters, Mikayla and Bianca. The move north made sense for a few reasons; beyond presenting a more appealing lifestyle, it provided strong career opportunities within the Police Force for both Craig and Sam. Craig is currently the Officer-in-Charge at a large police station whilst Sam, a Police Sergeant, is also based locally.

The Sandersons always considered their relationship with Steve and Invest Blue to be a long-term one. Even from their initial discussions, Steve outlined a map that went well into the future and covered what was important in relation to their financial security many years down the track. And those early decisions of Steve’s have certainly given them pause, this year more than ever.

One of the first things Steve looked at for his new clients was their insurance policies. As police officers in potentially high-risk roles, securing Income Protection Insurance is a tremendous challenge for Craig and Sam and so, as an alternative, Steve put in place Trauma Insurance as one of the components of their Life Insurance cover. In January this year, the importance of having this cover already in place was brought to the fore.

Craig, a healthy 41-year old was on holiday in Sydney, training for a half marathon when he suffered a heart attack. Whilst it took some time to be correctly diagnosed, a genetic heart condition was discovered and two surgeries followed. Several months on, Craig is doing wonderfully well and looks forward to a long and bright future with his girls.

Upon reflection, Craig says, “our insurance cover gives us tremendous peace of mind for our family into the future if something were to occur. I take comfort in knowing there would be sufficient cover in place, cover I would not otherwise have been able to take up having recently been diagnosed with a heart condition. And it’s all thanks to receiving Steve’s professional and correct advice a number of years ago.”

The relationship with Steve remains one of trust and communication and the expectation is for Steve to continue to guide Craig and Sam well into their retirement. There are also plans in place for Mikayla and Bianca so that they too will enjoy a secure financial future. In the shorter-term, the focus is to set money aside for their high school tuition and university fees.

Craig appreciates Steve’s “tailor-made approach” to the family’s finances and says,

“I’m grateful that he stays within our comfort zone in relation to risk while still presenting other options to us. Steve’s always willing to answer our questions and to improve our knowledge of financial systems and financial options. We value his engaging, hands-on approach.”

At 42 and 40 years of age respectively, Craig and Sam find themselves in an enviable position. They take much pride in their career achievements to date and have the financial freedom to enjoy life whilst knowing their future is secure. With the support of Steve and Invest Blue, the Sandersons are encouraged to not only think about where they’re headed as a family but also to position themselves to enjoy the here and now as well.

Taking time to unwind has always been important for Craig and Sam. In fact, it’s essential they do so given the nature of their work and the often-challenging day-to-day events they experience. Craig’s health scare earlier in the year also highlights how unpredictable life can be sometimes and reminds us all why it’s so important to enjoy the ride.

Craig and the three wonderful women in his life plan on doing just that. With funds set aside for regular holidays, this outdoorsy family will most likely be found flying down a steep slope somewhere in the Aussie ski fields or riding high on their stand-up paddleboards in the warmer months. And all the while, Craig’s heart will be full.

Would your family be ok if you were unable to work? Ensure your financial security today, get in touch.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

These clients have agreed to share their story. Everyone’s situation is different, so their choices and outcomes will be different to yours. Consider your circumstances before deciding what’s right for you.