When the open road is calling….

February 14th 2019

Karl and Julie Graham’s current residential status is ‘no fixed address’ – and the couple couldn’t be more thrilled.

After a lifetime of hard work, including successful careers supplemented by seasonal work on their weekends and holidays, the Grafton natives are living out their retirement dream, travelling across Australia in a caravan.

“This has been a long-term plan of ours, and we definitely feel we’ve earnt it,” Karl smiles.

“We worked hard, both in the office and in the paddock during the annual wheat harvest, and now it’s time to sit back and put our feet up.”

Having enjoyed a 30-year career in the local council, while Julie’s career lay in retail management, Karl admits they were both extremely strict with finances during their working years.

“I started working at 16 and that’s when I had my first life insurance with AMP, which later rolled into my super.”

“Throughout our careers, we put as much of our income into super as possible, through salary sacrifice, and while we kept enough to be able to live, planning for our caravan retirement was always a financial priority.”

Invest Blue Financial Planner in Grafton, Tom Merrick said the couple well and truly deserved their dream retirement.

“Their goals were made possible by introducing lifelong cash flow modelling, exemplifying the long- term impacts of such decisions,” Tom believed.

“As a result, they now enjoy great flexibility as to how they live their lives in retirement.”

Two years leave up his sleeve afforded Karl the opportunity to finish working at the age of 58, which coincided with the purchase of the couple’s caravan.

However, they were cautious that the reality of their long-held dream may not, potentially, be for them.

“We kept our house and rented it out, so we had a back-up plan, but in the end living in our caravan was even better than we expected.”

In fact, it was the rental of their home that proved the challenge, ‘we had a few bad tenants over the years, and the phone calls when things went wrong and we were so far away were always tricky,’. And so, after seven years on the road, the Graham’s recently sold their house to further fund their travels.

“It’s a relief, to be honest, and as we’re too young for the pension and this is a self-funded lifestyle, it gives us enormous freedom to continue our caravan travels.”

“Unless things crash drastically, we can afford to keep travelling indefinitely – having that security is of great comfort.”

If, and when, the time comes for the couple to slow down, their strategy will be to rent, rather than buy, a home, allowing them to continue moving as they wish to destinations of their choice.

“There’s no point taking money out of our super just to purchase a home at our age, so this strategy suits us perfectly and gives us total freedom,” Karl believes.

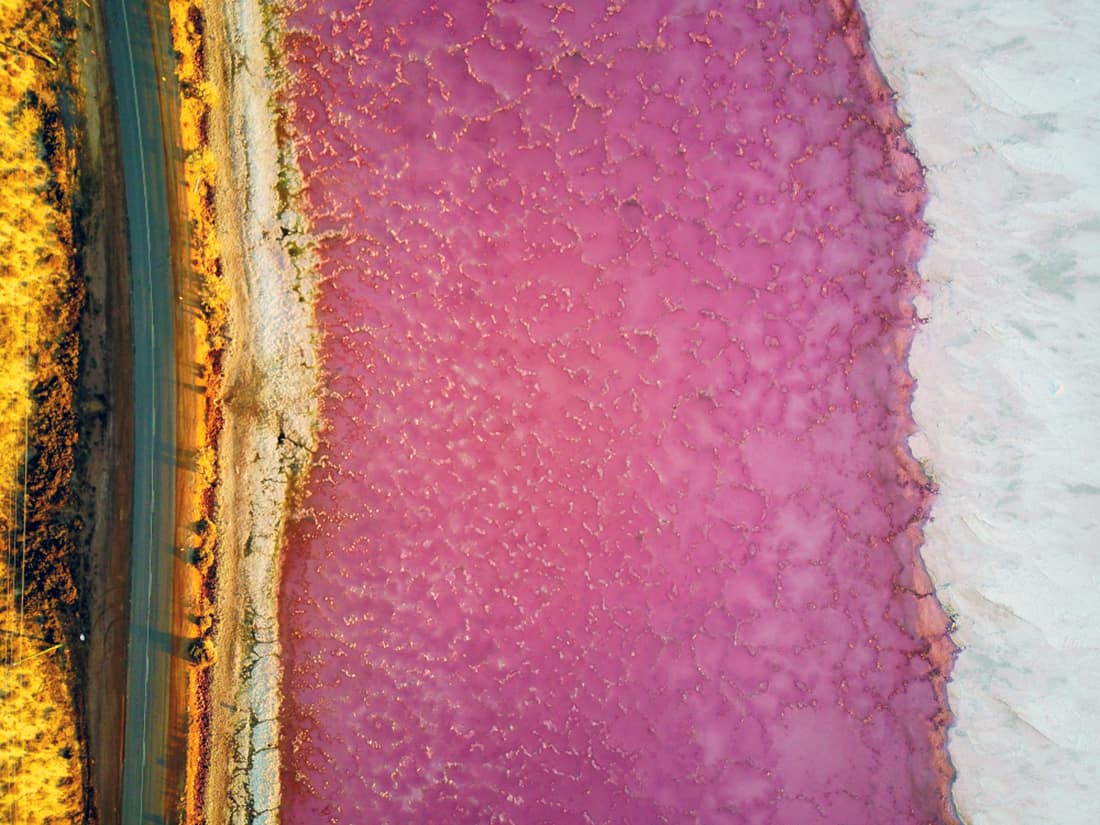

The couple is currently in Western Australia, the last Australian State left for them to explore – and they’ve not been left wanting.

“It’s very pretty with beautiful scenery – it’s just so relaxing to come and go as you please, pull up and stop if you want, keep driving by if not – we really feel we have the perfect lifestyle.”

With family-based on farms in the Grafton region, there is always a place for Karl and Julie to pull up and recover when needed.

And after seven years of travelling across Australia, it seems they needn’t have travelled far at all to seek out their number one destination.

“Yamba for sure is still our favourite spot in Australia, we spend a lot of time there and it never ceases to amaze us.”

Like Karl and Julie, do you have a dream retirement in mind? If you would like to discuss planning for this dream and how you can make it a reality, please get in touch.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

These clients have agreed to share their story. Everyone’s situation is different, so their choices and outcomes will be different to yours. Consider your circumstances before deciding what’s right for you.