Credit Card debt trends and comparisons

December 12th 2019 | Categories: Debt Management |

Carrying credit card debt is not uncommon, so how does your credit burden stack up?

We know that over time there have been many examples of credit card debt disasters – maxed out credit cards, living on credit, owing to significant amounts across multiple cards. There is no doubt that access to debt via credit cards can present a danger zone, and we have seen it negatively impact clients of all ages and income levels.

Despite hearing the cautionary tales, have we learnt our lessons though? What is happening now in terms of credit card debt? As a country, are we getting better or worse at managing debt? In this article, we explore trends for, and comparisons between, credit cards.

Current Trends

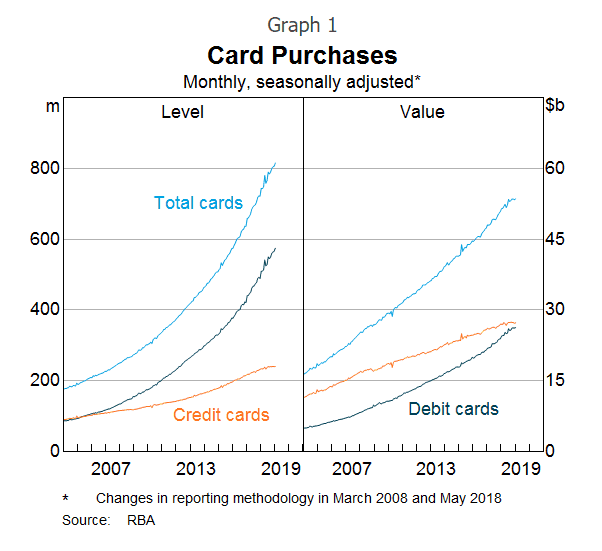

According to the RBA, there were 15,693,936 credit card accounts in Australia as at August 2019, that netted a monthly national debt accruing interest of $30 billion[1]. That is equivalent to $1,911 per account per month. According to the RBA, these numbers are still growing, and have been steadily increasing over time. We have also seen the significant rise of debit cards in the last 15 years, with the number of cards and the total amount spent both growing rapidly[2].

Graph 1: Credit and Debit Card Growth

Similar results can be found in a survey by finder.com.au, that points to the fact that whilst there has been significant growth in debit cards over the years, that Australians are still spending up big on credit cards[3]. The survey reports:

- Number of Credit Cards in circulation – 15,796,092

- National Australian spend on purchases each month – $27.7 billion

- Average Credit Card purchase – $122.68

- Average Debit Card purchase – $45.21

- Average Credit Card balance – $3,258

- Average Credit Card balance accruing interest – $1,986

- Average percentage of credit limit used – 34%

The survey also looked at the number of cards across different age groups:

Table 1: Number of cards by household by age group

| 18-35 | 35-54 | 55+ | |

| Card ownership (%) | 65.07% | 82.18% | 79.84% |

| Own one card (%) | · 39.48% | · 34.70% | · 32.79% |

| Own two cards (%) | · 17.59% | · 26.79% | · 29.53% |

| Own three+ cards (%) | · 8.36% | · 20.69% | · 17.52% |

Source: finder.com.au/credit-cards/credit-card-statistics, 20 September 2019

We can see from this data that as a nation, we are not good at paying off our balance in full each month, accruing significant interest charges. It also shows that most Aussie adults own at least one credit card. Multiple card ownership is more prevalent in the 35-54-year-old age bracket, followed closely by the 55+ age group.

If you are concerned about debt and how to manage your finances, Contact us today or reach out and ask us a question. We have a team that is here to help.[ninja_form id=37]

Has credit card usage changed over time?

Further results from the finder survey shows that there have been some changes in credit card usage over time.

Table 2: Changes in credit card usage over time

| Measure | 2018 | 10 Year Average | % Difference |

| No. of Credit Cards in circulation | 16,216,996 | 15,558,217 | 4.2% |

| Average balance per card ($) | $3,211 | $3,202 | 0.2% |

| Average balance costing interest per card ($) | $2,007 | $2,176 | -7.77% |

| Total number of purchases | 2,088,798,392 | 2,000,786,562 | 4.39% |

| Total purchases spend ($) | $240,421,518,854 | $262,409,721,900 | -8.38% |

Source: https://www.finder.com.au/credit-cards/credit-card-statistics September 2019

We can see from the above that there has been little change in the balance per card, however, there has been a reduction in the closing balance, suggesting that Australians are getting better at paying off their cards before the interest due date. This is backed up by data from the RBA, that states in a senate committee report that credit card debt balances accruing interest have fallen from around 75% to 65% since 2012[4].

The total number of purchases has increased in line with the number of cards, however, the total spend on purchases has decreased, showing Australians are spending less on their credit cards over time. This may be due to other economic factors more so than the rise in debit cards.

The above indicates that while there are some positive trends, there is still a heavy reliance on credit cards in Australia.

If you are struggling with debt and need some clarification and guidance to achieve your goals, contact us today.

Credit Card Comparisons

OK, so we know credit card usage is still big business, but how do we decide on the best card, or even compare what cards are available?

We used comparison site Mozo.com.au to scope the market and were presented with 226 options. We used a ‘Main Driver’ to look at different cards, selecting the top card each time. We then compared what each card offered. From the below you will see that deciding on what card is best, is really about what you’re looking for.

Table 3: Comparing Credit Cards*

| Main Driver | Top Card in Search | Purchase Rate | Interest-Free Period | Balance Transfer Rate | Annual Fee | Rewards Program |

| Low Interest | ANZ Low Rate | 12.49% p.a. | 55 days | 0% for 15 months and then 20.24% p.a. | $58 | N/A, however, includes complimentary insurances. |

| Frequent Flyer Rewards Program | ANZ Frequent Flyer Black | 20.24% p.a. | 55 days | No current offer. | $425 | 1 point per $1 (8,000 points required for Syd-Mel flight). |

| Points-based Rewards Program | Citi Platinum – Bonus Points Offer | 21.49% p.a. | 55 days | 0% p.a. for 15 months then 22.24% p.a. (1.00% balance transfer fee). | $149 | 80,000 bonus points by spending $3,000 within 90 days of card approval. 19,500 points required for Syd-Mel flight. |

| No Annual Fee | American Express Velocity Escape Card | 20.74% p.a. | 55 days | 0% p.a. for 12 months and then 20.74% p.a. (1.00% balance transfer fee). | $0 | 0.75 Velocity Points per $1 on regular spends. 7,800 points required for Syd-Mel flight. |

| Balance Transfer | Citi Platinum – Balance Transfer Offer | 21.49% p.a. | 55 days | 0% p.a. for 26 months and then 22.24% p.a. (1.50% balance transfer fee). | $49 in the first year then $149 p.a. | Transfer points to airline programs or redeems on a range of rewards. Complimentary International Travel Insurance. |

*Please note that this data is not complete and has been taken directly from the source on the date below. The source should be consulted for all data, not this report.

Source: https://mozo.com.au/credit-cards, 3rd December 2019.

So depending on what your needs are, there are different options available. If you’re after a low-interest rate, you can start on 12.49% p.a., However, if it is a rewards program or balance transfer you’re after, you might be charged 21.49% interest on purchases from the get-go. Whatever your needs are, do your homework, and make sure you can pay off your card at the end of each interest-free period to avoid paying unnecessary interest.

Where to next?

A report by the Australian Securities and Investments Commission (ASIC) states that credit card debt causes problems for 18.5% of consumers as of June 2017[5]. Younger credit card holders were more likely to misuse cards, as were those with multiple cards. The report goes on to state that some consumers have cards that are not well aligned with their actual needs or spending patterns, and that it is a challenge for consumers to select the right card.

Financial Advice can help you to work out a strategy if you are struggling with credit card debt or have debt living in multiple locations. Our team of Advisers are well-versed in debt consolidation, wealth management, investment strategies and in developing a unique plan for you that is anchored to your goals and dreams, and what you really want to achieve.

Contact us today or book an appointment with an Adviser to start to get on top of your spending. You can also take our Financial Health Check as a start point for managing your finances. No matter what your approach, we are passionate about helping people realise their dreams and goals and in guiding you to make better financial choices. For help and advice, contact us below or ask us a question You can also check out our team here.

[ninja_form id=41]

[1] https://www.rba.gov.au/statistics/tables/xls/c01-1-hist.xlsx

[2] https://www.rba.gov.au/publications/bulletin/2019/mar/new-payments-insights-from-the-updated-retail-payments-statistics-collection.html

[3] https://www.finder.com.au/credit-cards/credit-card-statistics

[4] https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/Credit_Card_Interest/Report/c02

[5] https://download.asic.gov.au/media/4801724/rep580-published-4-7-2018.pdf, p.24

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Debt Management