First Homeowners – current benefits and what to be aware of before sealing the deal

June 16th 2020 | Categories: Home Loans & Leveraging Equity |

The Reserve Bank of Australia dropped the cash rate to 0.25% in March 2020. The decision was taken to keep the Australian economy afloat in times of a looming recession. The low-interest rates ensure that borrowing remains affordable, and the economy can recover as soon as possible.

Impact of Low-Interest Rates on the Property Market in Australia

The low-interest rates directly translate into low borrowing costs. This could present a great opportunity to take advantage of these low interest rates and invest in the property market for the first time. However, there are some things to consider first.

The prices of houses have also slightly dipped during the pandemic with suggestions property prices could dip as far as 20%. However, the downturn is only expected to be temporary, and the house prices should take a strong rebound in 2021. It gives home buyers a perfect opportunity to make use of the low house prices and low-interest rates to enter the property market and earn through capital appreciation.

You can read more on this in our article “outlook in interest rates”

Understand how a financial adviser can support you with your need for financial security. Get in touch.

[ninja_form id=37]

Before you jump in, here are some things to consider:

- Know your area: location can impact how variable prices are during market cycles

- Understand how your property type performs in that area: i.e. apartments do well in some areas but can be more impacted by cycles than houses in others. Understanding the demand for your property type can help you understand how variable its value might be

- Consider whether you can add value: if your property is a ‘fixer-upper’ you may be able to add value to it even in a declining market cycle.

You may also be interested in our article “is now a good time to invest in the property market”

Government Benefits to Encourage Property Markets

The Government of Australia has released several incentives and benefits to encourage growth in the construction industry and property market.

HomeBuilder program: The owner-occupiers who meet the eligibility criteria will receive a grant of $25,000 to build a new home or renovate an existing one. The contract for such homes must be signed between June 4, 2020, and December 31, 2020, and construction must begin within three months of signing the contract. The HomeBuilder program is expected to cost about $680 million to the government. However, it is expected to serve the purpose of boosting the economy and the property markets in Australia.

First Home Loan Deposit Scheme: Eligible first home buyers can purchase a home with a deposit of as little as 5% and avoid Lenders Mortgage Insurance (LMI). This presents first homeowners the perfect opportunity to buy sooner rather than later and could save you thousands on LMI fees. With the impacts COVID has had on our economy, property prices could fall so it’s important to consider that you may owe more than the value of the home with a 95% loan which could put you into negative equity. Having a long-term financial plan and carefully considering your investment is the best way to manage this.

First Home Owners Grant: Provides a one-off grant of up to $15,000 for QLD and $10,000 for NSW & VIC to first homeowners who buy a new house or apartment. Eligibility and maximum property values vary state by state.

Stamp duty exemption or concession: The exemption is provided if the purchase price is less than $600,000, while the concession is applicable for homes with a purchase price between $600,001 and $750,000.

The new grant program is complementary to the already existing State and Territory First Home Owner Grant programs, stamp duty concessions, and other schemes like the First Home Super Saver Scheme. This means in grants alone first homeowners could receive up to $40,000 in grants when building a new home. As a result, it makes home-buying more affordable for the first home buyers and allows you to enter the property market more cost-effectively.

[bs_button size=”block” type=”link” value=”Download your First Home Buyers Guide” href=”https://www.investblue.com.au/first-home-buyer-lp“]

Areas to Consider Before Borrowing

Despite the various concessions, exemptions, and incentives offered by the Australian government, there are additional upfront and ongoing costs that you should be aware of before entering into the property market. The upfront costs are usually associated with the value of the property and its location. They include conveyance and legal fees, building and pest inspection charges, mortgage registration fees, transfer fees, loan application fees, mortgage insurance, and council and utility rates, among others.

Here is a price breakdown of fees provided by realesate.com for a QLD property.

- Property value: $500,000

- Conveyancing and legal fees: $1800

- Stamp duty: $0 for first-home buyers, $8750 for others

- Building and pest inspection (combined): $600

- Mortgage registration fee: $187

- Transfer fee ($35 for every $10,000 over $180,000): $1120

- Loan application fee: $500 – $600

- Mortgage insurance: $8000

- Council and utility rates: roughly $500 (per quarter)

- Total costs = $512,707 – $521,557

As you can see there are many upfronts and ongoing fees that may take first homeowners by surprise. Before buying it is important to have insurance in place to help cover your mortgage repayments if you were to lose your job or be unable to work. It is also important to review your budget and ensure you have an adequate amount to put towards ongoing annual fees such as council and utility rates as well as maintenance and repair costs. Having an emergency fund set aside will help provide a buffer for these kinds of events. In your budget, it is also important to include all ongoing fees whether they are annual, monthly or weekly.

You can try our free budget planner here.

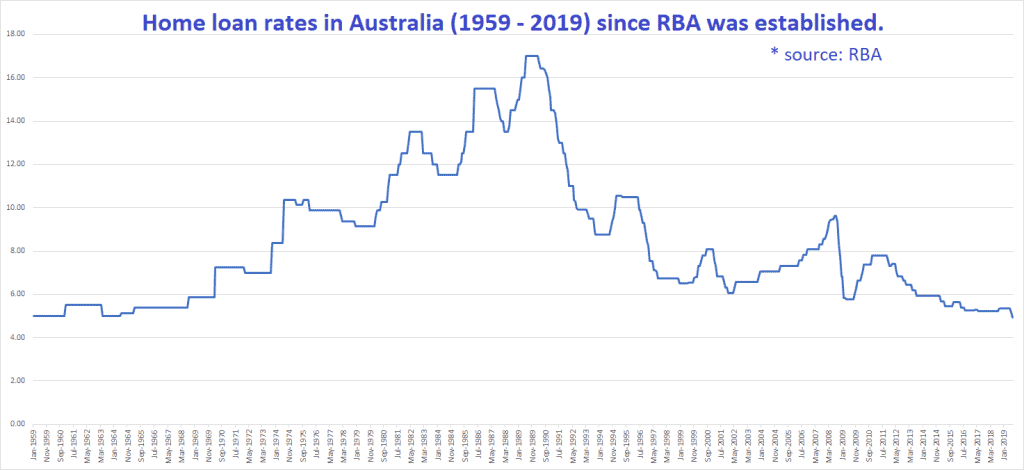

Interest Rates: Finally, you need to consider movement in interest rates. What would you do if interest rates were to fluctuate again? Could you afford the repayments if interest rates when up an extra 3-5%? While interest rates are low, and many economists predict they will remain low for some time, you need to keep in mind that rates have been as high as 17% in 1989-90.

It may be worth considering locking in a fixed interest rate for a certain amount of time, this will allow you to know exactly how much your repayments are each week. This also gives you room to ride out turbulence in the property market and reevaluate your investment when the fixed interest period is complete. There are downsides to fixed mortgages as well, so it is worth discussing your options with an adviser who can help you understand what is best for you in your situation.

Once you have carefully reviewed and taken into consideration your financial position, investment selection, extra fees, a fixed or variable interest rate and the property market, you will have a better idea of what you can afford not only upfront but also on an ongoing week to week basis. We encourage you to seek the advice of a professional such as a mortgage broker or financial planner to carefully review your entire financial position and take into considering your long-term goals and dreams.

Speak to us today to find out how we can help you.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Home Loans & Leveraging Equity