Holiday spending and the economy

December 2nd 2020 | Categories: Financial Planning |

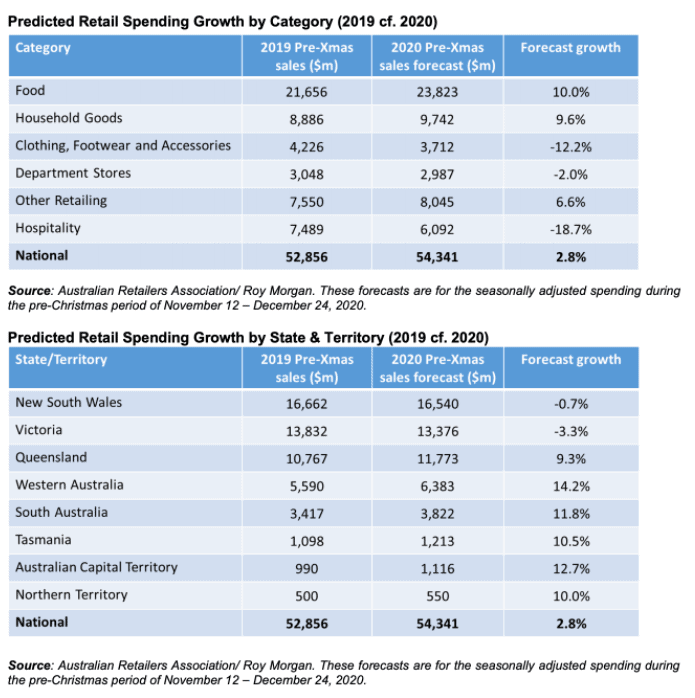

Recent insights from the Australians Retailers Association reveal Christmas holiday spending is expected to increase by 2.8 per cent this year, injecting $54.3 billion dollars into the economy. This may come as a surprise considering the financial disruptions many have faced this year due to COVID-19.

If you would like to discuss your options and how you might manage it from a financial perspective, please get in touch.

[ninja_form id=37]

Outlook on spending

The positive economic outlook on spending is largely due to government stimulus packages, which have helped to boost household spending. This includes the recent cut to interest rates, tax rates and COVID-19 relief payments. Borders reopening are also allowing spending to increase across the travel and tourism sectors with QLD, WA, SA and TAS expected for growth.

While spending insights are looking positive as a whole, areas such as hospitality are still limited to capped venue numbers and are expected to perform 18 per cent lower than previous years. In terms of retail sales, they are 12 per cent lower, indicating gift spending may be decreasing but spending will be made up in other areas. Victoria and New South Wales have been the most heavily affected COVID-19 states across the country and are also expected to see little growth in comparison to other states.

While many households have benefited from stimulus packages, not all have been eligible, and many people are still facing financial hardship. With that in mind, it’s worth considering how you can spend your money to support small businesses, those in need, and at the same time boost the Australian economy.

You may be interested in our market update “five reasons why this downturn and subsequent recovery are different – and where are we in our recovery now?”

The mindset of shoppers

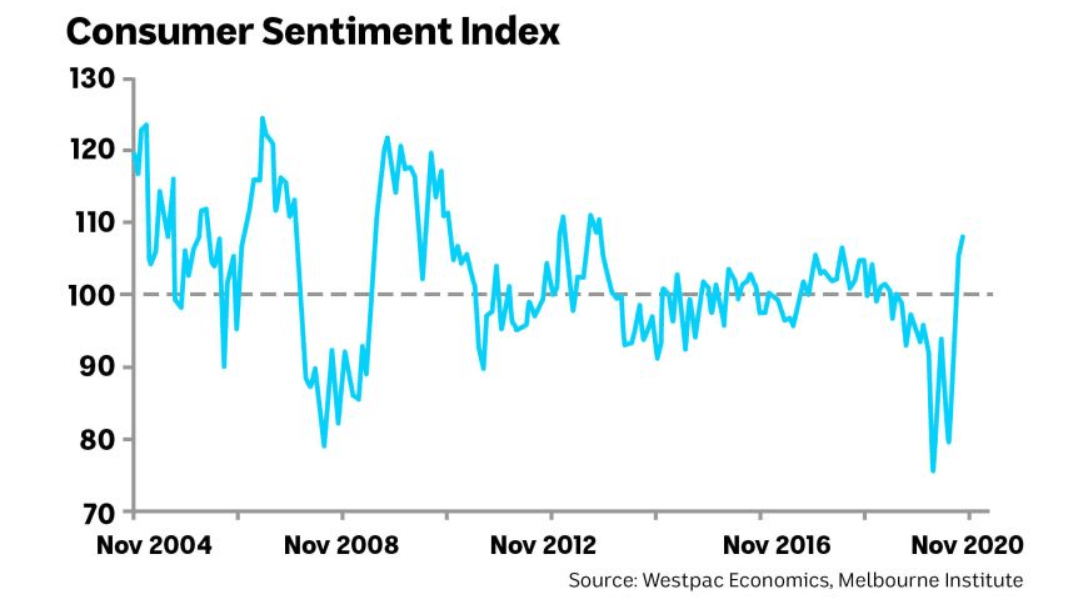

With the above figures indicating a drop in sales across retail an additional report by Westpac’s consumer sentiment survey found a 7 year high in consumer confidence. With that said it’s also recorded 11.5 per cent are planning on spending more on gifts this year and 32.3 per cent are expected to spend less.

As we can’t be sure what lies ahead many families are choosing to keep their savings left aside this Christmas and spend less on gifts after a reduction.

For the many Australians still out of work or only just starting to see pay cheques coming back into their account, up to 44 per cent of people will be relying on credit cards to make it through the festive season as revealed by Toluna Research.

Shop to support the economy

The way we spend our money can have a direct impact on not only the community around us, but consciously shopping and being aware of where your dollars are going, can help keep Australians in jobs and help the recovery of the Australian economy.

Shop local

The easiest way to directly support Australians and the economy is to shop locally. Australian Government figures show that 98 per cent of all business in Australia are considered as ‘small business’ and employs over six million Australians – that’s 44 per cent of our workforce. The report also reveals that small businesses account for 35 per cent of Australian Gross Domestic Profit.

Tips on shopping local:

- Shop instore where possible, retailers are some of the hardest hit by the pandemic

- Consider local small businesses over large chain stores e.g your local hardware store

- Visit your local markets for both your produce and gift shopping

Shop Australian Made

Shopping for Australian made products directly supports the entire chain of workers from start to finish and is one of the most effective ways to support workers and the economy.

The simplest way to do this is by looking for the Australian made logo on products or by searching by category on the Australian Made websites search tool. You can find it here.

Shop Australian Owned

Supporting Australian owned businesses is also important to the recovery of our domestic workforce and economy. The green and gold logo identifies brands, companies and services that are over 80 per cent Australian owned. With many iconic Australian brands being sold off to overseas owners it’s worth investigating, which brands you can switch to, to help keep money onshore.

You may be interested in our article “get ready for Christmas”

Supporting those in need

Giving back is front of mind this year with many families experiencing varying levels of financial hardship throughout the year from such events as the bushfires, drought and COVID-19.

Given this, many are choosing to donate to charity over traditional gift-giving. A survey by states 47 per cent plan on donating money this Christmas and a further 48 per cent say in this circumstance they are genuinely happy that the charity got the benefit than themselves.

Invest Blue proudly supports the Salvation Army Christmas Appeal, at each of our office locations by having collection drop-offs available for both food and gift donations. This year we feel it is particularly important to dig deep and show our support for those in need and to help spread the Christmas joy across our community. If you would like to donate, please feel free to drop off any food or gift donation at your local Invest Blue office.

While the outlook on Christmas this year is looking strong there are various ways, we can consciously choose to support both our local communities and the Australian economy. If you have been impacted financially by COVID-19 you may find our support page useful.

Speak to us today to see how we can help you financially recover from COVID-19.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Financial Planning