How 2020 changed our financial attitude and mindset?

December 10th 2020 | Categories: Financial Planning |

Although 2020 produced moments of fear and uncertainty, it was also a time where we were given the opportunity to pause, learn a few lessons, reprioritise and adjust to a new normal.

And, as the year comes to a close and the holiday season approaches, we discuss how the last 12 months may have changed the way you perceive and value your finances now and into the future.

We also discuss how to best use the holiday period to get financially back on track and develop your financial recovery plan for 2021.

If you would like to discuss your options and how you might manage it from a financial perspective, please get in touch.

[ninja_form id=37]

Ways COVID-19 changed our financial attitude and values

As many Australians faced reduced work hours or job loss due to COVID-19, personal finances were put into the spotlight. The last time Australia experienced an economic drop and national debt to this extent was during WWII.

This had a significant impact on how people chose to manage their finances, with many withdrawing all funds from the stock market and bank accounts.

There is some good news from this, as we can learn from history’s past to better manage and develop a financial recovery plan to help navigate a potentially challenging year/s ahead.

Recouping our savings

As COVID-19 sparked the 2020 financial collapse, research conducted by HSBC found there was a shift in our financial behaviour, as we tried to offset the financial damaged caused by the pandemic. Our focus moved more towards financial security and savings.

Some key findings were:

- 35 per cent saved more during this period

- Many began building emergency funds

- Home loan repayments increased

Job security top priority

The mindset of how we perceive jobs has also changed with two in three people stating they would choose job security and less stress over a higher paying job, as revealed in a recent survey by Seek.

A further 47 per cent stated the pandemic has made them rethink their career. In addition, it highlighted casual or contract work is now less desirable.

Where we live?

One of the biggest financial attitude shifts we’re seeing as a result of the pandemic has been the ‘sea change’ and ‘interstate migration’ movements of Australians.

As reported by the ABC, it spoke with Gold Coast real estate agent, Tolemy Stevens who’s seeing “80 to 90 per cent of my transactions over the last three to six months alone have all been from buyers either in Melbourne or in Sydney, which is just a phenomenal statistic.”

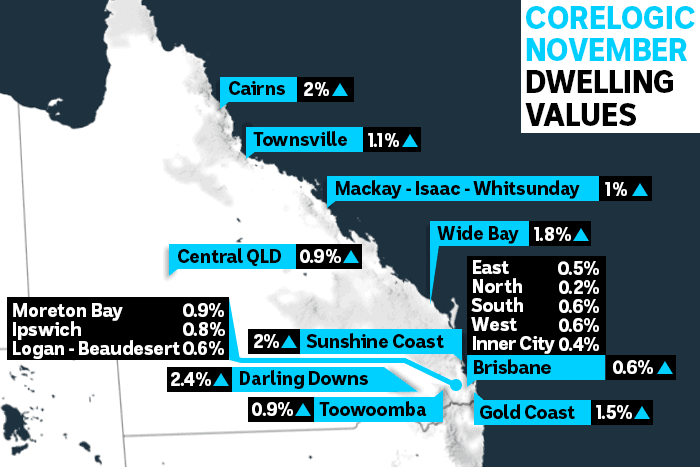

This movement is creating a spike in the demand for both rental and property market, driving up housing prices. Particularly for the Sunshine Coast, Cairns, Brisbane and Gold Coast as indicated in Corelogic’s November Dwelling report.

Many are also taking advantage of government incentives such as the HomeBuilder Scheme, First Home Deposit Scheme and record low-interest rates to get into the property market.

This is helping to stabilise and stimulate demand for the property market, particularly for new developments, which in turn is contributing to our economic recovery.

You may be interested in our article “first home buyers on the rise 2020”

One client’s COVID-19 financial recovery plan

As many Australians work to offset the financial impacts of COVID-19, it’s heart-warming to hear of cases of people getting back on track and navigating their way to achieving their financial dreams and goals.

Our client, Libby and Igor were amongst those impacted, as Igor the primary income earner was working in tourism.

As this industry and his job security changed almost overnight, they left their Brisbane home and relocated to North Queensland so Igor could work in the mines. Libby and Igor had been seeing Invest Blue Financial Planner, Travis Stanley who helped them map out their financial recovery plan and get them back on track to achieving their long-term financial goals.

“Travis set us up with income protection, which is hugely reassuring if we ever need to go down that path, he’s encouraged us to maintain a realistic budget so we can enjoy our lifestyle, and his understanding of investments gives us confidence that we are in a far better place financially than we would have been without his guidance,” Libby said.

They have since been able to return to Brisbane, and while they are still behind due to the impacts of COVID-19 they are making grounds to a strong financial recovery. You can read their full story here.

How to use the holidays to get on track for 2021?

A New Year is commonly seen as a time for reflection and setting new goals, although statistics reveal almost all New Year money resolutions are given up by March. However, by remaining disciplined and using this time effectively, it can help create positive long term financial habits and put plans into motion to recover financially.

To help you get on track for 2021 here are our top four tips:

1. Review current loans and debt

With interests’ rates at a record low now could be a good time to refinance, it’s important to not just focus on the advertised rate but also considered other fees and the variable interest rate.

Our Lending Team will be able to assist you in finding the right loan for you that is going to work in your favour. If you’re currently paying over three per cent in interest, there is the potential to make savings on your home loan or pay down your loan faster in this unique environment.

2. Review your financial position and factor in financial security

This includes reviewing all your current expenses and income, creating a budget is a great way to do this. You can download our free budget planner here. A budget can also help you identify how much you could potentially be saving and or investing.

You should also consider how much you would need to live off if you were to lose your job and how you would manage your repayments. Ideally, you should build an emergency fund to the value of three months’ worth of expenses, you never know when the unexpected could turn up again.

Review your insurance policies, do you have income protection? Could you get a better deal on your home and content insurance? You may also have insurance built into your superannuation, so it’s worth reviewing your super to avoid doubling up on insurance fees.

3. Consider your short term and long-term goals

Are you trying to buy a house? When would you like to retire? Are you trying to become debt-free? The sooner in life, you identify these goals the sooner you can start working towards achieving them. If you’re unsure of where to start with goal planning, you may find our goals worksheet useful.

A great short-term goal that can help throughout your entire life is leaning and growing your financial literacy. There is now an abundance of free resources such as books, podcasts, eBooks and blogs like ours here, which can help you on your financial journey.

4. Seek the advice of a professional

Actually achieving your financial dreams and goals takes discipline, time and commitment. If you’re serious about achieving them, then making the right financial decisions for your situation is important.

Seeking the advice of a professional can provide you with the right guidance, tools, latest insight and resources to get you there faster.

While you may be focused on one goal, there may be other areas you may not identify as important. This is why seeing a financial adviser can be a valuable resource. They can review your entire financial position and make the necessary changes to help you on your journey to finding financial security.

As 2020 has shown us just how unexpected life can be, it’s important to plan ahead and identify ways you can build on your financial security.

Speak to us today to see how we can help you.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Financial Planning