The Australian economy bounces back again

September 27th 2017

In the quarter, growth was helped by a pick-up in consumer spending and business investment, strong public investment and a contribution from net exports after a detraction in the March quarter.

Key Points

- Australian growth bounced back in the June quarter helped by consumer spending, investment and trade.

- There is good reason to expect growth to pick up further going forward: the drag from mining investment is fading, non-mining investment is looking better, public investment is strong, trade is adding to growth and profits are rising again. But growth is likely to be constrained around 2.5-3% and underlying inflation is likely to remain low.

- Expect the RBA’s cash rate to remain low for a while yet and Australian shares to move higher by year end, but to continue under performing global shares.

Growth bounces back (again)

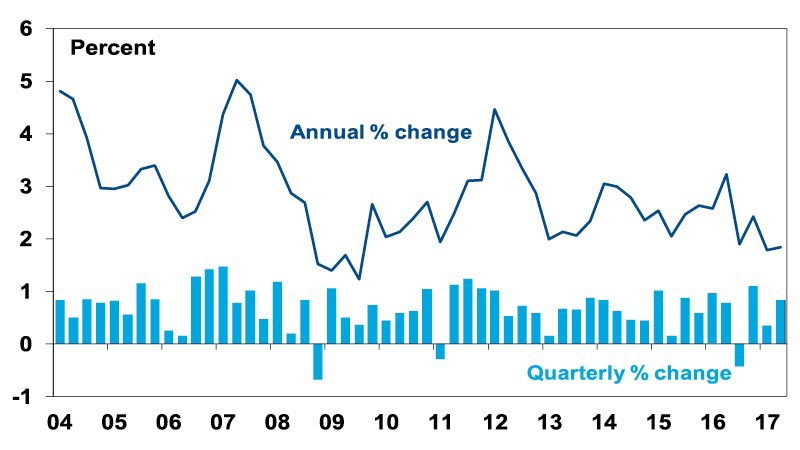

After another (weather related) soft patch in the March quarter, Australian economic growth bounced back in the June quarter with quarterly growth of 0.8%, up from 0.3%. However, annual growth is still subdued at 1.8% year on year, which is well below potential of around 2.75%. In the quarter, growth was helped by a pick-up in consumer spending and business investment, strong public investment and a contribution from net exports after a detraction in the March quarter.

What does the bounce back mean for you and your investments? Get in touch to discuss.

[ninja_form id=37]

Australian real GDP growth

Australia continues to defy the doomsters’ endless recession calls. Against this, economic and underlying profit growth is lagging compared to that seen in major economies. However, there are some positives pointing to a pick-up in growth.

Threats, risks and worries

Putting global threats aside, Australia’s worry list is well known:

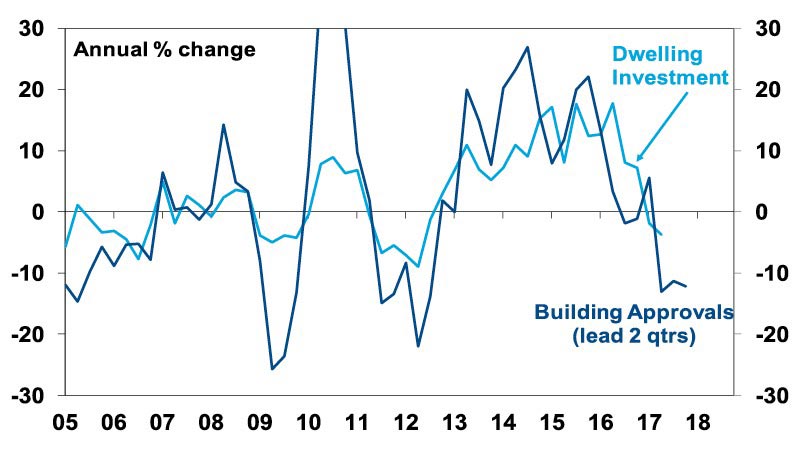

- Housing construction is starting to slow with falling approvals pointing to a further slowing (see next chart).

Falling building approvals leading slowing dwelling investment

- Related to this, there is the risk of a house price crash “as seen” on Four Corners. However, there have been endless property crash calls since around 2004. In the absence of a stronger supply surge, the Reserve Bank of Australia (RBA) making a mistake and raising rates too high and/or unemployment surging, our view is that a slowdown in Sydney and Melbourne is likely, but not a crash.

- Consumer spending is constrainedby record low wages growth and high levels of underemployment. While consumer spending has been running faster than income growth, as rising wealth has allowed consumers to run down household savings (to now just 4.6%) this is unlikely to continue as the wealth effects flowing from property price gains in Sydney and Melbourne slow. Rapid power cost increases and high debt are also not helping. All of which is driving low consumer confidence.

- Mining investment is still falling with business investment intentions pointing to another 22% fall this financial year.

- The Australian dollar is up 16% from last year’s low and at around $US0.80 (and threatening to go higher) it is at risk of slowing growth (and investment) in trade-exposed sectors like tourism, agriculture and manufacturing.

- Underlying inflation is too low and risks staying below target for longer due to record low wages growth, a rising $A, competitive pressures & weak rents as new supply hits.

- Our political leaders seem collectively unable to undertake productivity-enhancing economic reforms and take decisive action (eg, on energy policy). With the citizenship crisis threatening an early election, it’s unlikely we will see an improvement any time soon.

Five reasons to expect growth to improve

These worries are well known and despite them we remain of the view that recession will be avoided and growth will pick up over the year ahead:

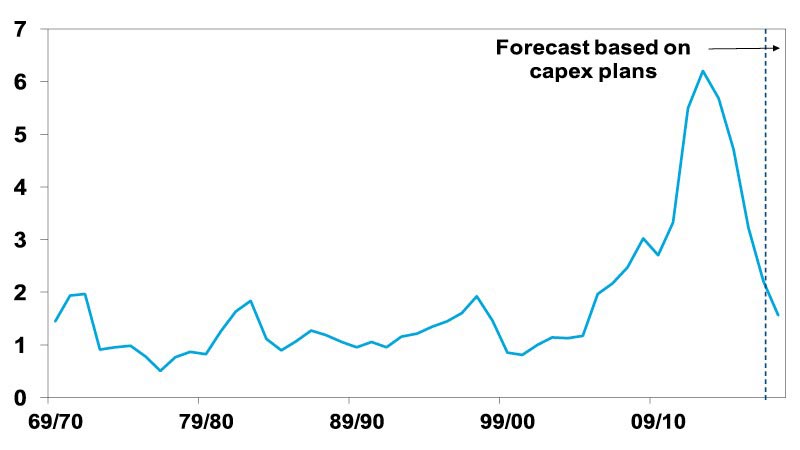

- First, the growth drag from falling mining investment is nearly over. Mining investment peaked at nearly 7% of GDP four years ago and has since been falling at around 25% per annum (pa), knocking around 1.5% pa from GDP growth. At around 2% of GDP now its weight in the economy has collapsed, reducing its growth drag to around 0.4% this year and it’s near the bottom (see next chart).

Mining investment as % GDP

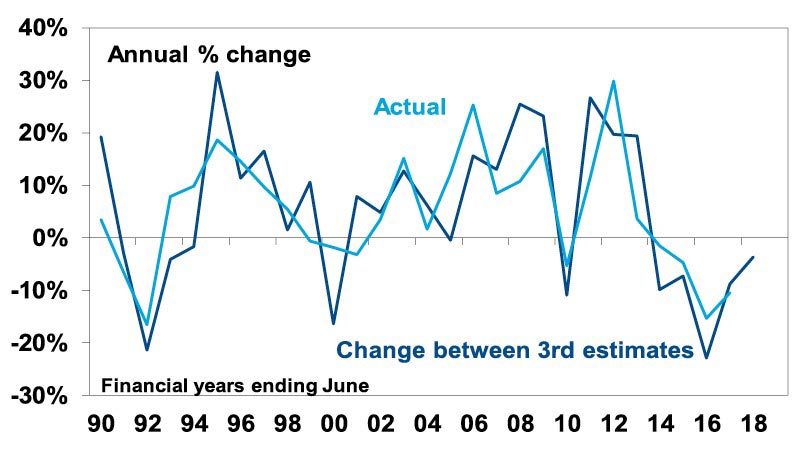

- Second, non-mining investment is likely to rise this year. Comparing corporate investment plans for this financial year with those made a year ago points to a decline in business investment this year of around 3.5% (see next chart). But this is the best it’s been since 2013 and once mining investment is excluded this turns into an 8% gain for non-mining investment.

Actual and expected capital expenditure

- Third, public investment is rising strongly, up 14.7% over the last year, reflecting state infrastructure spending.

- Fourthly, net exports are likely to continue adding to growthas the completion of resources projects boosts mining and energy export volumes and services sectors like tourism and higher education remain strong.

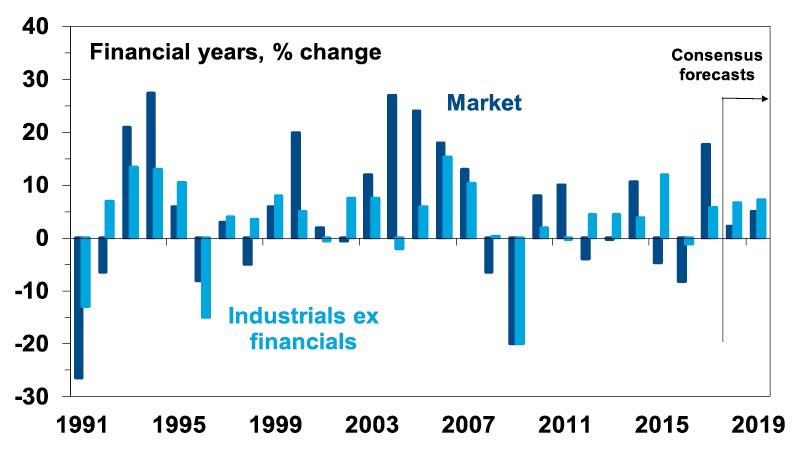

- Finally, profits for listed companies are rising againafter two years of falls. This is a positive for investment and the flow of dividends helps household incomes.

Australian share market EPS growth

These considerations should ensure that the Australian economy continues to avoid recession and that growth should pick up to around a 2.5% to 3% pace over the year ahead. This should be enough to head off further cuts in the cash rate. But with growth still a bit below RBA forecasts, wages growth likely to pick up only slowly, inflation likely to remain subdued abstracting from higher electricity prices, and the RBA likely wanting to avoid pushing the $A higher, our view remains that the RBA will keep the cash rate unchanged at 1.5% out to the December quarter 2018 at least before starting to raise rates.

Implications for investors

There are several implications for Australian based investors.

First, a return to reasonable growth is positive for growth assets. Australian shares are vulnerable to a short term US-led share market correction – given North Korean and Trump risks – but we remain of the view that it will be higher by year end.

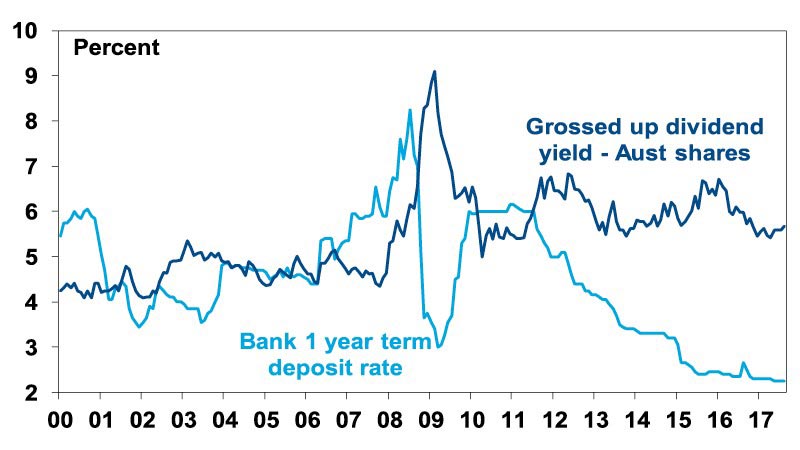

Second, bank deposits are likely to provide poor returns for investors for a while yet, highlighting the case for yield-focussed investors to continue to look for superior sources of yield. The yield gap between Australian shares and bank deposits remains wide, driving a strong source of demand for shares. After Telstra cut its dividend, just make sure you get a well-diversified portfolio of stocks paying decent dividends though.

Aust shares still offering a much better yield than bank deposits

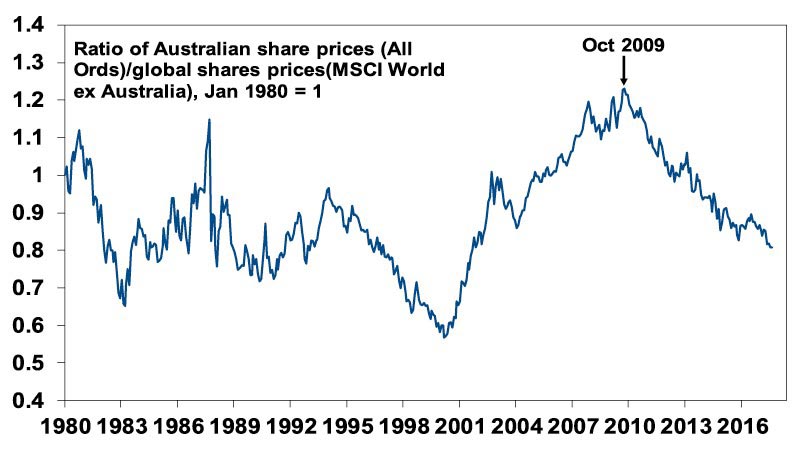

Third, while Australian shares are great for income, global shares are likely to remain outperformers for capital growth. In fact, global shares have been outperforming Australian shares since October 2009. This reflects relatively tighter monetary policy in Australia, the commodity slump, the lagged impact of the rise in the $A above parity in 2010, and a mean reversion of the 2000 to 2009 outperformance by Australian shares. And of course, abstracting from volatile resource company earnings, underlying profit growth at around 5-6% in Australia is well below that in the US (at around 11%) and Europe and Japan (at around 20-30%) so the underperformance of Australian shares may have a while to go yet. Which all argues for a continuing decent exposure to global shares relative to Australian shares.

Australian shares relative to global shares

Ensure your financial security and speak with an adviser today.

[ninja_form id=41]

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.