The markets are down, what should I do?

October 30th 2018

It’s a common question – for the average investor, market downturns bring up many emotions, and on average they are not nice ones. Worry, fear, doubt, guilt, …. When the market does cycle down, we do field enquiries from clients. They want to know what to do. They feel like a response is required. It seems an indication that the plan isn’t working, that a poor decision has been made. Surely, we must adjust and do something to ‘fix’ this problem?!

Or should we?

Well, the precise answer for any one person depends on a number of variables. But speaking on a higher level the answer is usually no.

If you would like to discuss your personal investment plan with a financial planner, please get in touch.

[ninja_form id=37]

Markets cycle. That is what they do.

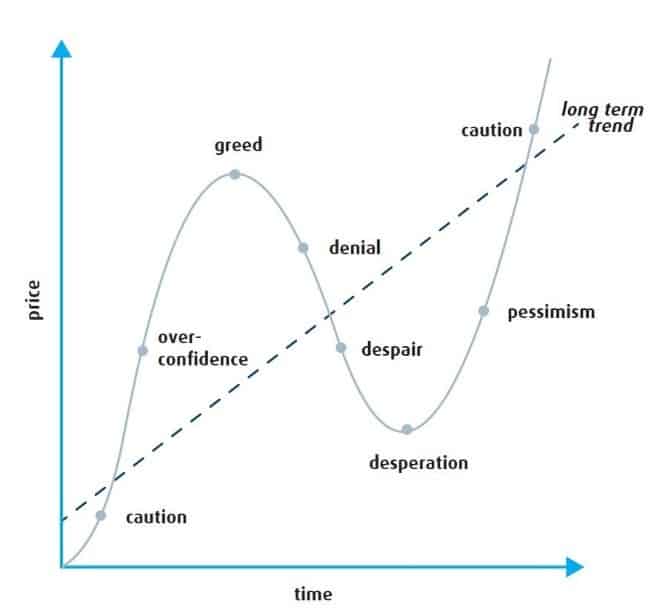

Financial markets and share values respond to a myriad of factors, some grounded in economic fact, or company performance. But they also respond to social factors. The ups and downs are magnified by human behaviour. When prices are going up, it instils confidence and people buy in. Increasing demand increases the price. More confidence, more demand, etc.

When there are negative indicators, people sell off. A bit of momentum in a sell can lead to worry or fear. Confidence is rocked and the market goes down. The more it goes down, the more confidence is tested. The more we sell, etc…

At the extremes, emotionally driven investment sees people buy high (when confidence seems high) and sell low (when fear sets in).

Emotion and risk

When we are looking after our own money, it is perfectly normal for emotion to get involved. We are not just talking about dollars and cents, we are talking about our sense of security, our feeling of freedom and control, and our ability to realise our goals and dreams. It’s important stuff!

What is commonly not understood, however, is how much risk we take on when we make decisions that are emotion-impacted. Earlier this year, we spoke about the five investing psychology traps you must avoid.

As you can see from the above graph if emotions get in the way are we are buying high and selling low, we will not do well from the investment. It is a very risky strategy.

Investment Philosophy: Balancing Risk and Return

As financial advisers, we see our job as helping you identify your risk preference, your goals and objectives, and then designing a financial strategy that helps you in your journey, according to your preferences. And then it is our job to do what we can to ensure you live up to that strategy year in and year out. Our Investment Philosophy or approach to wealth management is very much founded on the need to balance risk and return, and to be upfront about the risks being taken.

“At Invest Blue, we take very seriously the responsibility and trust given to us by our clients in managing their wealth. Our clients give us the responsibility of protecting and enhancing their wealth and as such, we take a cautious, risk-based approach to the way we manage money. We aim to maximise the probability of our clients meeting their objectives, whilst ensuring we implement a strategy that is consistent with their tolerance towards risk. We do this by focusing on the two components of investing; risk and return, aiming to achieve maximum return for the level of risk being undertaken.”

Timing the market

One of the ways to avoid having to try and pick market cycles is to take advantage of “dollar-cost averaging” which simply involves investing consistent, regular amounts throughout the cycle (in rising and falling markets), rather than a single lump sum, which relies more heavily on market timing.

As we wrote back in 2016, markets can be volatile. Learn about the three things to remember about market volatility. If you are doing your own investing, or someone is doing it for you, keep these nine tips in mind.

Checking in on your investments

It’s important that you check-in on your investments every so often. Is your investment plan suitable for your current goals and dreams?

Download our Investment Report Card to get started.

[bs_button size=”md” type=”info” value=”your investment report card” href=”http://www.investblue.com.au/investment-report-card/lp”]

If the markets are down and you don’t know what to do. If you have questions or concerns, get in touch with your adviser. If you don’t yet have one, come in for a chat.

We are here to help you make smarter decisions with your money.

We are here to help you realise your goals and dreams.

[ninja_form id=41]

What you need to know

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Invest Blue Pty Ltd (ABN 91 100 874 744) and Subsidiaries trading as Invest Blue, is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327, Australian Financial Services Licence and Australian Credit Licence No. 232706