What to consider when investing in a low return world

July 26th 2017

For some investors, volatility matters. When approaching retirement, volatility tends to matter more owing to sequencing risk. In the video below, we assess some considerations for investing in low return world.

Get in touch to discuss your investments and how you can achieve your dreams.

[ninja_form id=37]

Share market volatility is expected to remain elevated

Investment market volatility is essentially triggered by uncertainty around market fundamentals such as economic growth, earnings, dividends and interest rates; and investor psychology or emotion which can push markets to extremes, particularly when there is a surprise development or change in direction.

Uncertainty is elevated for three main reasons:

[bs_row class=”row”]

[bs_col class=”col-md-4″]

Global GDP growth is likely to remain weak: we expect global growth of around 3% this year, with the risk that it could disappoint to below 3%.

[/bs_col]

[bs_col class=”col-md-4″]

Unprecedented global monetary policy responses to persistent weak economic conditions: Almost everywhere in the developed world, interest rates are at or near record lows.

[/bs_col]

[bs_col class=”col-md-4″]

Government debt across developed markets is extremely high versus history.

[/bs_col]

[/bs_row]

The combination of these factors is contributing to global market uncertainty and investors will have to get used to episodic periods of elevated volatility for a while yet. This presents opportunities as well as risks.

To put the recent volatility into context, when you’re flying a plane at 30,000 feet – at a comfortable, cruising altitude, you have the ability to absorb some turbulence, but when you are flying over rooftops, the risk of error is heightened. Throughout time, we know that periods of volatility can and do occur in investment markets. Over the next 12-months, in this environment, bouts of volatility are likely to be felt keenly. Remember, we are skimming over rooftops. It is uncomfortable, more uncomfortable than when growth is solid and investment market returns are strong.

Considerations for investing in a low return world

We expect investment returns will remain lower for longer. Fortunately, time is on your side when it comes to investing as it smooths out short-term bouts of volatility. If you are invested in markets over the long-term and can handle the volatility, it’s a good idea to ride out short-term market movements. In saying this, if volatility and limiting capital losses matters, you may consider:

Taking advantage of market opportunities

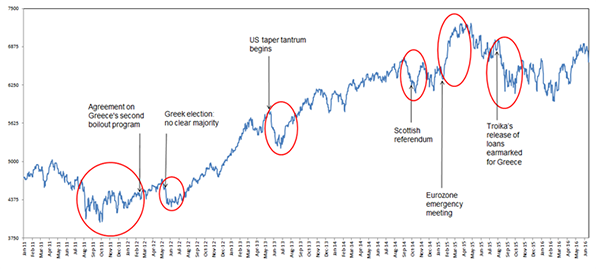

Increased investment market volatility often presents opportunities. When investors panic and overreact, this can force prices beyond reasonable valuation levels. If liquidity in markets also disappears, it often forces prices lower again. The chart below shows that the bouts of volatility stemming from the European debt crisis and fears of Greece exiting the Eurozone actually presented opportunities for active managers.

Source: AMP Capital, Bloomberg, as at 31 May 2016

Responsive and forward-looking investment processes

For a fund manager, actively managing volatility requires investment expertise in the form of a(n):

- Flexible investment framework that enables an investment manager to react nimbly. This may not always be possible through a rigid strategic asset allocation framework

- Track record of managing through similar periods

- Investment process that is both responsive and forward-looking

Our Dynamic Asset Allocation process in action

Taking a nimble, active and forward-looking approach to asset allocation can be an effective way to respond to market dislocations. Dynamic Asset Allocation (DAA) is used to actively adjust the holdings of investments across asset classes in response to expected market changes. For example, when markets have fallen, we may favour growth assets such as shares, whereas when markets are peaking we may favour more defensive assets such as fixed income and cash across our multi-asset portfolios. The process changes its emphasis depending on the conditions; it can respond to changes in investor sentiment and positioning as well as valuation and economic conditions.

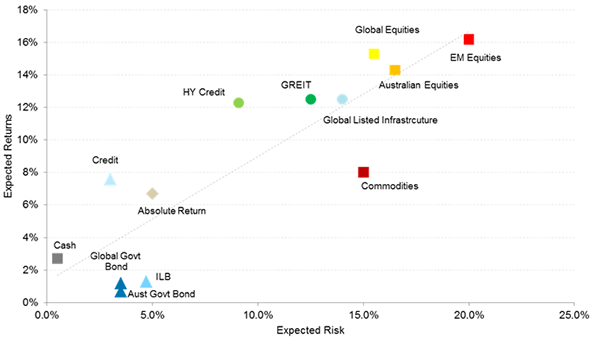

This chart below highlights asset return expectations in February 2016, as reflected in our dynamic asset allocation models.

Source: AMP Capital, Bloomberg, as at 29 February 2016

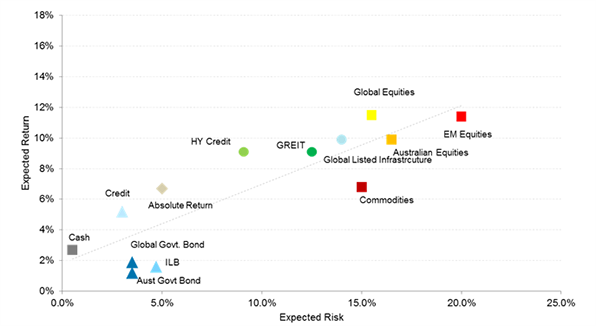

At that time, many markets had sold off violently and were oversold. Our models captured this by increasing forward return expectations across a number of asset classes and strategies. As markets have recovered the forward return expectations have come back down. This demonstrates the importance of being forward-looking and opportunistic.

Source: AMP Capital, Bloomberg, as at 31 May 2016