New Debt: The Rise of Buy Now Pay Later (BNPL)

December 5th 2019 | Categories: Debt Management |

We’re living in a fast-growing forever evolving “new world” with the rise of eCommerce stores drastically changing the face of retail. Rapid growth in tech industries is also changing the way we live our everyday lives. It feels like every month a new device or app comes out that you suddenly couldn’t imagine living without. It’s hard to believe only 10 years ago the majority of us were still using paper maps!

It’s with no surprise then that the digital era is also creating patterns of change for our finances, including our debt! This is what we like to call “new debt”, also referred to as “Buy Now Pay Later” (BNPL) debt.

Talk to us to help you work out how to structure your finances to achieve your financial and life goals.

[ninja_form id=37]

What is BNPL debt?

Buy Now Pay Later debt refers to companies such as Afterpay and Zip Pay who offer their customers repayment plans that allow them to receive their purchase straight away, either online or instore and then pay later. These services partner with retailers and customers to pay off their goods over instalments.

The idea is very similar to a layby, except that the goods can be taken home straight away. The service, it is fair to say, is popular, with the Sydney Morning Herald reporting that Australians owe more than $900 million in BNPL debt as at June this year[1]! Afterpay is the most common BNPL service provider in Australia, and we will be primarily referring to Afterpay as we discuss BNPL in this article.

Firstly, let’s take an example. You want to buy a pair of shoes for $180 and decide to pay with Afterpay. By selecting this option your payments will be split into four fortnightly repayments of $45, that suddenly doesn’t sound like much! It makes the purchase sound a lot more appealing, right?

It may let you have your goods straight away and help you organise your payments by having them on a repayment plan, however, the debt can creep up if you’re not careful.

How is BNPL debt different to regular debt?

BNPL companies don’t charge interest to their customers and are paid a commission by the retailer. They technically are not credit providers, and therefore aren’t covered by the National Credit Act. This also means they don’t check your credit score or consider your living expenses before providing you with a repayment plan. Anyone over the age of 18 with a debt card will be accepted to open an account and 60% of BNPL users are Millennials[2]which raises the conversation of “how millennial’s are managing their money”. Although there is no interest attached to BNPL debt you are charged a late fee of $10 if you don’t make a repayment on time and an additional $7 on top of this if the payment hasn’t been made within a week.

How do BNPL providers decide on how much you can borrow?

Afterpay accounts are linked to either a debit card or credit card, and although providers don’t check your credit rating before approving your loan, they do check your account balance to see if you can at least make the first repayment. Debit card BNPL loans caps start at $500 and can increase as you continue to make payments on time. Credit card BNPL loan caps are standard at $1,500.

Does BNPL affect my credit rating?

Afterpay reserve the right to make reports on failed payments to the credit rating bureaus which could lead to a black mark. Mortgage brokers also suggest closing any BNPL accounts three months before applying for a home loan as the maximum loan size will count towards personal debt within your application, even if you don’t currently have any repayments schedules in place. Click here to read our article on “What info is on my credit card and why does it matter”.

What is the BNPL debate?

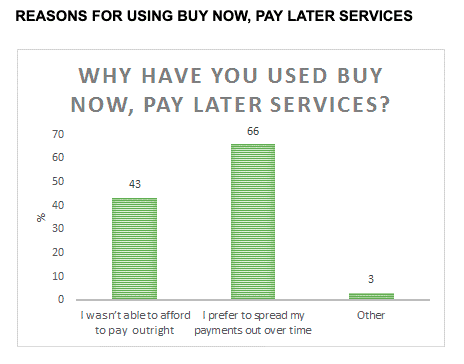

According to research by Which-50 Digital Intelligence Unit, there are two main reasons one would use a BNPL service; either they like the option to make smaller repayments over time as opposed to making a lump sum payment, or they can’t afford the item they want to purchase right now[2].

Table 1: Reasons for using BNPL Services

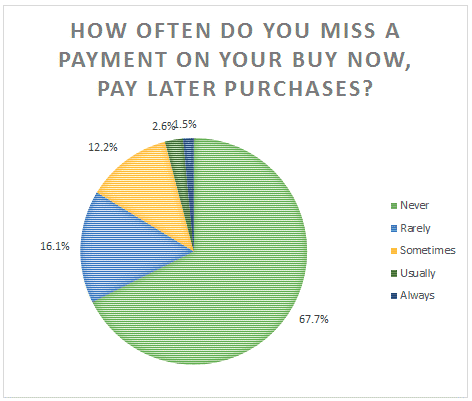

As the payment programs don’t factor in your living costs it raises the debate around whether individuals can afford to be purchasing goods in this way. Website Mozo reports one in three users are recorded to have missed a payment[3]. This is backed up by the Which-50 research:

Table 2: Likelihood of Missing BNPL Repayments

According to Which-50.com, ASIC reports 44% of BNPL users to have a salary of less than $40K which could make meeting repayments difficult depending on the loan size.

Those making the repayments on a credit card need to be extra careful of not letting this debt get out of control. Although Afterpay doesn’t charge interest, paying with a credit card and not making those additional repayments could quickly land you in an interest-accumulating position.

How does BNPL compare to credit card debt?

BNPL services have been stated by the Sydney Morning Herald to be the “credit card killer” with the masses switching from regular use of credit cards to this interest-free service.

Let’s look at when to use a BNPL service compared to a credit card:

- Afterpay has no interest and repayments are automatically withdrawn from your account on a schedule of four fortnightly payments, lowering the risk of incurring a $10 late payment fee.

- Afterpay has maximum loan size between $500 – $1,500, so Afterpay is better for small luxury expenses such as new shoes, last-minute gifts and now even services such as hair salons.

- Zip Money does allow for purchases over $1,500, however, the limit will vary from person to person. It has no interest for the first three months and a $6 account fee per month if you have an owing balance. This choice would be ideal if you can guarantee you can complete all payments within the first three months. This service can be great for medium expenses such as replacing your car tyres.

- If you need to borrow more than $1,500, for example, you want to purchase flights, the interest rate on a standard credit card is 19.77% and credit cards typically have a repayment window of 45-55 days prior to interest being charged. Paying off credit card debt before the due date is crucial in ensuring your well budgeted holiday doesn’t end up affecting your finances later down the track.

How to use BNPL responsibly

With Christmas around the corner, BNPL could be a great alternative to unintentionally racking up more additional debt on a high-interest credit card.

It could also help you manage your repayments so you aren’t financially hit as badly in the case of filling the Christmas stockings all at once.

It’s estimated this year 27% of Australians will pay for Christmas Presents using BNPL[3]. Before you go “swamping yourself” in repayments and starting the new year off three steps behind on your new year financial goals, consider these steps for responsibly managing your BNPL accounts:

- Set a budget (that is not the limit a BNPL provider gives you) and figure out what you can comfortably afford to pay off fortnightly for the next 2 months.

- Keep track of how many open repayment plans you have active so you don’t accidentally blow your budget.

- Set aside money from your pay. Afterpay will send you payment reminders both 4 days & 1 day prior to each payment being withdrawn from your account but having the money set aside to make the repayments is the most important element in avoiding late payment fees and ensuring you pay off your purchase.

Although we recommend avoiding any bad debt where possible and only buying what you can afford and need, a BNPL account can have a lot of pros on small purchases compared to a credit card. Ensuring you managing your repayments responsibly is the key.

Do you need help managing debt and aren’t sure where to start? You can review our Debt and Lending Philosophy and reach out and ask us a question.

We have worked with thousands of clients, including people who need help and assistance with budgeting, debt consolidation, lending needs and setting meaningful goals for the future.

We have a dedicated Lending Team as well as a team of credentialed Financial Advisers.

Contact us today to put yourself on the path to living your best possible life, and you can also take our Financial Health Check to get you started.

[ninja_form id=41]

[1] https://www.smh.com.au/business/banking-and-finance/time-to-pay-aussies-owe-more-than-900m-on-afterpay-20181128-p50iyf.html

[2] https://which-50.com/buy-now-pay-later-debt-will-soon-hit-1billion-how-sustainable-is-the-model/

[3] https://mozo.com.au/credit-cards/articles/buy-now-pay-later-report-2019

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Debt Management