Our take on the Federal Budget 2020 – winners and the forgotten

October 27th 2020 | Categories: Federal Budget |

Compared to other years the latest budget is relatively tame, with little change that would have an immediate impact on the financial advice we give our clients. With that said, some areas came out on top and some opportunities were missed altogether.

This year’s 2020 Federal Budget was one of the most critical for the nation as we experience our first recession in nearly 30 years and face a $214 billion deficit, the highest since World War II.

Unveiled by Treasurer Josh Frydenberg, the Coalition Government’s plan to get Australia back on track was on recovery, spending and jobs.

As with any budget released, there are some areas that came out on top and some opportunities that were missed altogether.

We closely break these down and highlight some of the key winners, as well as those who have been largely forgotten.

If you would like to discuss your options and how you might manage it from a financial perspective, please get in touch.

[ninja_form id=37]

So, who were the key winners from the budget?

Business

One of the largest winners from the budget was for 99 per cent of businesses. It was found that those companies in a position to spend, will be able to gain instant asset write off benefits until June 2022. A $1.3 billion plan to help boost such industries across manufacturing, food and beverage, medical and resource technology.

In addition to this, businesses are encouraged to help get Australians back to work through the JobMaker hiring incentive. Those businesses who hire new employees aged 16-35 years will be eligible for a wage subsidy for up to $200 per week.

DOWNSIDE: On the flip side to these wins, those businesses who are struggling and not in a position to grow or “spend”, there was less on offer to them.

Also, it has been argued that the unemployed and older demographic have been heavily missed as the JobMaker hiring incentive favours younger Australians, who have more opportunities to acquire work and hold more debt e.g. mortgage.[1]

Pensioners

Our older Australians were another group who were considered a winner from the Federal Budget. There are two main benefits and changes that impact pensioners and those self-funded retirees holding a Commonwealth Seniors Health Card.

Firstly, they will receive an extra $500 stimulus payment – a $250 payment in December and then another in March 2021. This will be on top of the two $750 payments already received this year due to COVID-19.

Secondly, Capital Gains Tax (CGT) on granny flats have been abolished. This means our older Australians will benefit from the tax exemption and encouraged to enter into formal written agreements which use to trigger a CGT risk on a property. This in return, will make it easier for families to care for their loved ones.

Speaking with Invest Blue Financial Planner, Chris Ogilvie he believes;

“An area of a recent change that has big potential ramification for those nearing retirement is the extension of the age limit to 67 from 65 to make non-concessional contributions,” he said.

“We are currently awaiting legislation to see if we can use these bring forward provisions,”

“This, and the work test exemption, which gives those stopping work between 67-75 an extra year to contribute to their superannuation, are potentially big items for many pre and post retirees.” Chris added.

You can read our full article on changes to work test age here.

DOWNSIDE: While pensioners have received benefits, some say they would have preferred an increase to pension payments instead, and once again feel they have been forgotten.

Also, for self-funded retirees, some argue that they will be forced into risky investments to stay afloat unless there is extra support provided.[2]

Taxpayers

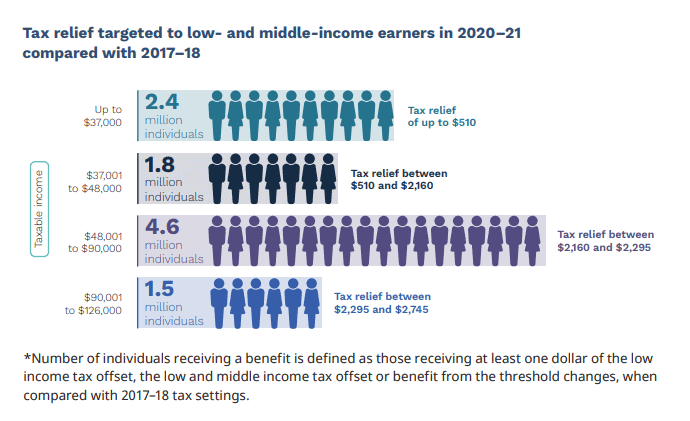

Tax cuts are among the biggest announcements of this year’s budget, particularly for low to middle-income Australians, with more than 11 million taxpayers overall to get a break.

The Government has brought forward their planned personal income tax cuts backdating legislation to start from 1 July 2020. So, this means Australians won’t need to wait till next year for their take home pay to increase and will see the change happen within months.

Also, low- and middle-income earners can potentially gain up to $1,080 in 2020-21 from a one-off tax offset.

Will you benefit? Check out the below figure highlighting the tax relief amount by taxable income:

Overall, the 19 per cent tax bracket threshold will rise from $37,000 to $45,000, while the 32.5 per cent bracket will increase from $90,000 to $120,000. And, the 45 per cent bracket will rise from $180,000 to $200,000.[3]

DOWNSIDE: High-income earners were forgotten in this budget announcement with their planned tax cuts not being brought forward as per lower- and middle-income earners. Their cuts are not expected to come into effect until 2024.

First home buyers

Next winner was for first home buyers, with 10,000 places becoming available for first home buyers to access the five per cent deposit scheme, enabling those approved to avoid paying Lender Mortgage Insurance and securing a home with just a five per cent deposit with selected banks.

In addition, borrowers will benefit from cuts to red tape around responsible lending obligations. This aims to reduce the cost and time it takes to access loans, as the bank will no longer be required to trawl through such expenses including Netflix and Uber Eats.

If you or someone you know wants to take advantage of the first home buyer deposit scheme offer, our lending team will be able to assist you with your loan application.

You may be interested in our article “first home buyers on the rise 2020”.

Superannuation account holders

Superannuation account holders were one of the winners in this budget, firstly with the Government’s early release of super scheme remaining open to eligible Australians until 31 December. You can read more here.

Secondly, changes made to automatically created super accounts for employees starting a new role have been scrapped, as well as, super funds are now required to meet a performance test, and if they do not perform must notify their members.

An online tool called, YourSuper will complement this change to help Australians compare different funds. All in all, these changes will help Australians save on unnecessary fees.

Your Mental Health

Looking at other areas, health was another priority particularly, mental health. As a result of the coronavirus pandemic, an additional 10 mental health sessions are now subsidised by Medicare. This doubles the free available session amount from 10 to 20. The scheme commenced on the 9 October and will run until 30 June 2022.

You may be interested in our article “weathering the pandemic – how to minimise financial stress”.

Support Payments

Various benefit payments will continue into 2021 such as JobKeeper, the previously mentioned pension support payment and the early super release scheme.

DOWNSIDE: However, with the coronavirus support payment ending on the 31 September and JobKeeper currently extended up until the 3 January 2021, some households particularly single parents or the unemployed could face further financial difficulty once this end.

You can find our market update detailing key fiscal updates and economic reports here.

Overall, the 2020 Federal Budget has had lower impact compared to previous years, particularly to spaces such as your superannuation. For financial advice, this means not too many needs to be changed or adjusted in terms of ongoing structuring or planning.

With the focus being on spending and recovery and with additional hard-earned dollars making their way back into the hands of taxpayers, we do believe the economy will recover over time.

Speak to us today if you would like to discuss your financial position or understand how these changes may impact you.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

[1] https://www.abc.net.au/news/2020-10-08/who-feels-left-out-federal-budget-disability-pensioners-youth/12741026

[2] https://www.abc.net.au/news/2020-10-08/who-feels-left-out-federal-budget-disability-pensioners-youth/12741026

[3] https://budget.gov.au/2020-21/content/factsheets/download/tax_fact-sheet.pdf

Posted in Federal Budget