A guide to testamentary trusts

August 30th 2022 | Categories: Aged Care |

What is a testamentary trust, how it works, and can it help with preparing for an Estate Plan.

A testamentary trust is a type of trust established under a valid will, distinct from the deceased estate itself. Unlike other trusts, a testamentary trust only takes effect upon the death of the will-maker. It functions similarly to a discretionary family trust, where specific provisions in the will act as the trust deed, allowing for flexible management of assets and protection for beneficiaries

In simple terms, to set up a trust, one person transfers property to a second person to be held for the benefit of the third. The person who transfers the property is called the “grantor” or the “settlor”. The recipient of the property is called the “trustee”, and they are the person/entity who take legal title of the transferred property. A trustee may also be a beneficiary – provided they are not the only beneficiary.

The beneficiary

A trust deed spells out what the trustee needs to do with the property.

The beneficiary is the person the trust is created for.

The beneficiary may have a present interest or remainder (future) interest in the trust.

A beneficiary has a present interest if they have a right to immediate benefits (e.g. distributions of trust income). A beneficiary has a remainder interest if the beneficiary’s benefits will not begin until sometime in the future (e.g. number of years or the death of a named individual).

A testamentary trust is a trust created by a Will, becoming active when you die. Instead of your assets passing directly to your beneficiaries, they pass into a trust. The trust is then controlled by a trustee, who you appointed in your Will. The Will details how the trust will work and records its terms and conditions, which can be drafted to suit your needs.

How can testamentary trusts help with my estate planning?

Trusts are used for a variety of purposes in estate planning including:

- Allowing your intentions to be implemented ‘beyond the grave’;

- Providing flexibility to allow income and capital to be divided between beneficiaries in amounts determined by the trustee to help reduce tax. Distributions from a testamentary trust to children under the age of 18 years are taxed at adult rates rather than at the usual children’s penalty tax rates. The trustee can take into account the other income of beneficiaries before distributing the funds to minimise the total tax on the amounts distributed to beneficiaries.

- Provide flexibility – a testamentary trust can be changed any time before you die.

- Potential for more advantageous treatment under Social security rules;

- A reasonable level of protection of beneficiaries against creditors and bankruptcy;

- A reasonable level of asset protection upon the beneficiaries’ marriage/de facto relationship breakdown

- Asset management – assets are placed in trust to relieve the beneficiaries from asset management responsibilities. This may be particularly important when minors, elderly people, incapacitated people or financially unsophisticated spouses are beneficiaries of the trust.

- Control, as a trust enables you, to place restrictions upon the use of property after you die.

Case Study: income splitting in a testamentary trust

Mark has determined that his family needs $30,000 pa net to maintain their lifestyle if he dies.

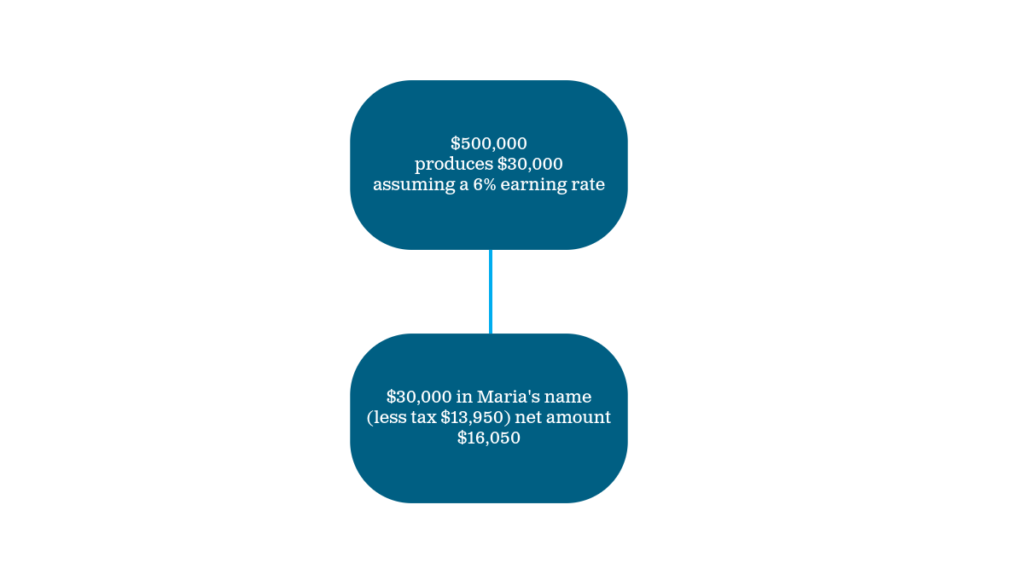

Scenario 1

Mark passes away, leaving an insurance policy of $500,000 to his wife Maria to provide income and maintain a lifestyle with no specific provision for his two young children.

Let’s assume the income earned by Mark’s wife will be taxed at 46.5%, the highest marginal rate.

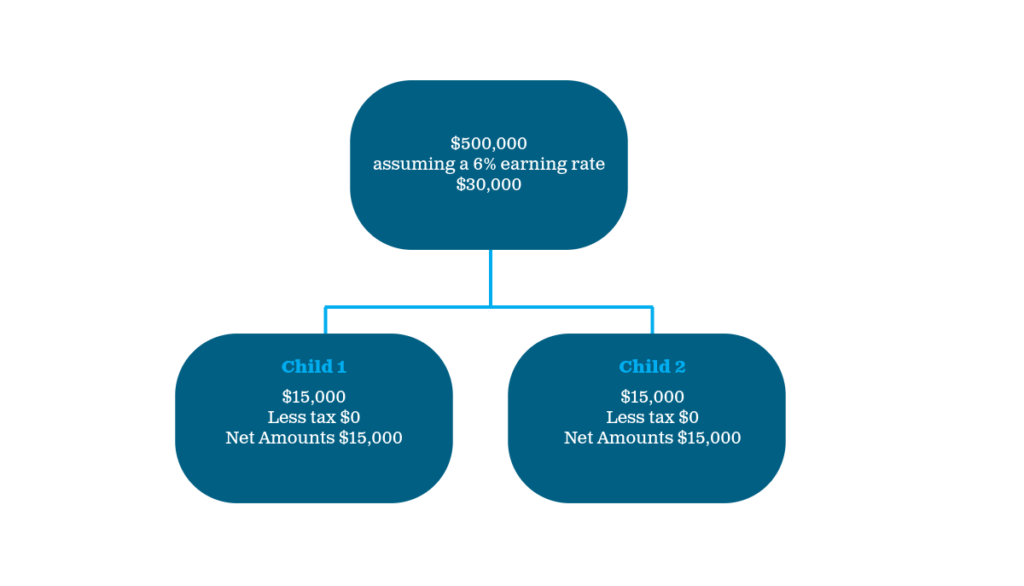

Scenario 2

If Mark’s estate is instead used to set up a testamentary trust with his wife and children being named as beneficiaries, the family can take advantage of tax-effective income splitting.

Income earned by the children in this particular situation is not subject to tax at penal rates. It is taxed at adult rates and attracts the full benefit of the low-income tax offset.

Please speak to your solicitor to determine whether a testamentary trust is appropriate for you.

If you would like to speak with one of our trusted financial advisers about your estate planning, please get in touch via the form below.

Still not sure? Why don’t you try our complimentary 15-minute discovery call. The first step in gaining clarity on your financial journey. Book here.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Posted in Aged Care