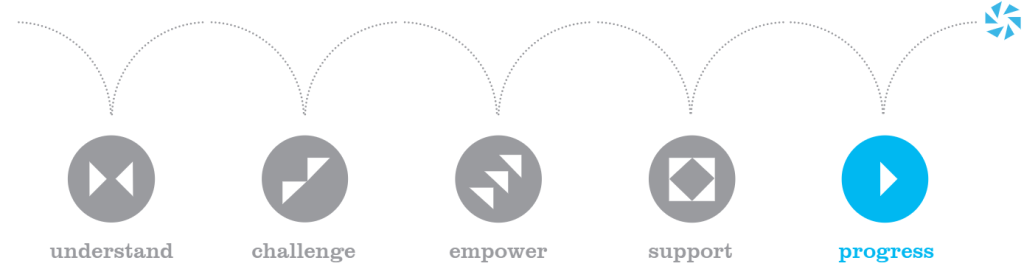

Your Advice Journey

No matter what stage of life you are in, we are here to help.

It all starts here

At Invest Blue, we are passionate about empowering people to realise their goals and dreams so that they can live their best possible life.

We pride ourselves on delivering holistic advice to our clients which means we help with every aspect of your finances.

In some instances, there is an immediate need that has to be addressed in a tight time frame, for example, the purchase of a house. For most, however, to truly build a financial plan that delivers on your best life, our approach is holistic and takes some time.

So how does it all work?

The Meeting Rhythm

Understand: A complimentary initial consultation designed around understanding what is important to you. Your goals, values and future plans and where you currently are on your financial journey. In this meeting we will all discuss how we can help and if we can add value.

Challenge: In this meeting we challenge your current financial position based off findings and research after your first meeting. From here there is a $500 commitment fee to proceed.

Empower: Empower you with the confidence and understanding of your proposed financial strategy and what that means for your future.

Support: Ensuring you are familiar with navigating your financial strategies and products.

Progress: Our ongoing relationship. We will continue to check in, monitor your progress towards your goals, be here to for you when things change and continue to develop your strategy to help you live your best possible life.

Not 100% sure if you’re ready for financial advice? Why not try our complimentary Discovery Call with one of our Advisers.

Meeting frequency

Our existing clients meet with their adviser formally, generally once a year. If your situation is more complex or you are going through a change of situation, you may meet more than that. These meetings are called Progress meetings because we want to ensure you are living your best possible life and progressing towards your goals and dreams.

Once we have worked with you to understand your dreams and goals, and the ways in which we can support you to meet your objectives, we will provide you with our recommendation as to how frequently we should meet to track the progression of your goals and adjust for changes as they arise.

The complexity of your situation and your desire to meet to discuss your financial goals will be factors in determining how often we come together to undertake a formal review. You can always request an additional progress meeting if your situation changes.

What you will pay

Your initial consultation with us is complimentary. If after that first meeting, you would like to progress to the next research stage, you will be charged to recover some of the costs incurred in reaching this stage. If you agree to the strategy presented, your initial advice and establishment costs will typically fall in the range of $3,000 to $10,000 depending on the nature, complexity, and size of the advice and implementation required. For future years, there is an ongoing advice cost for working with our team. This cost varies based on the type of ongoing advice, its complexity as well as the time and resources we need to bring to meet your ongoing requirements. Our ongoing advice packages start at $2,400 plus GST pa.

We have four support packages based on complexity. Your package will be determined by your situation and preferences. These are as follows:

| Access | Enhance | Elevate | Exceed |

| This is a portfolio review service only, and is for clients with who have less than $150,000 to invest, and are not seeking a review on their situation outside of their risk profile and investment portfolio. This package includes an annual review over the phone or through video chat per year. | This is an entry level package that suits those who have relatively simple financial affairs and less than $500,000 to invest.This will suit those just starting out on their financial journey or are later in their retirement years.This package includes one formal annual review with an adviser per year. | The elevate package is our standard package that suits the majority of our families that we work with. You may have a slightly more complex financial situation, multiple goals and a combined wealth of more than $500,000 to be managed. This package includes one formal annual review with an adviser per year. | The exceed package is designed for those who have a more complex financial situation and may have multiple investments such as a SMSF, Trust or multiple entities. This package includes one formal annual review with an adviser per year. |

Your Adviser will recommend the most suitable ongoing package for you based on the complexity of your situation and the amount of support you require.

Wealth Management Pricing

Additionally, if you undertake one of our active Wealth Management solutions, you will be charged a fee based on the amount you have invested. This means that when you undertake an active Wealth Management solution with us, we also charge a percentage-based fee that is applied to the balance of your investment. The more you have invested, the lower the percentage applied; these fees range from 0.80% to 0.65%.

Our range of portfolio solutions are designed to meet the unique needs of our clients.

| Foundation: Passive or Active | Dynamic | Bespoke |

| This is for those who in conjunction with their ongoing financial advice would like to build a Wealth Management solution that utilises a set and forget approach.This is generally managed as a single fund that can be either passive or active.This portfolio solution isn’t as tailored as Dynamic or Bespoke and therefore is a cheaper investment alternative for some. | For those who want to work with a financial adviser to review their financial situation, help plan for their future and build a Wealth Management solution.This involves high quality research and a more defined approach around risk vs return. The investment is managed by our third party investment specialists and monitored by your Adviser. | This is designed for those who want to review their financial situation, help plan for their future, and build a Wealth Management solution in a bespoke fashion, tailored only to them.This will result in a highly tailored and bespoke portfolio. This typically suits a more sophisticated investor and requires a research specialist which comes with a higher cost. |

Before work commences, you will be told what costs we will apply to your situation. Each year we will review and discuss your support needs, determine appropriate costs and provide you with a quote in your Annual Advice Agreement.

Take the first step towards the life you’ve imagined.