Why is goal setting, and achieving, so hard?

August 3rd 2018 | Categories: Budgeting & Goals |

For some, identifying a goal and setting out to achieve it is a black and white kind of thing. They know exactly what they want and can describe it in detail. They can build a plan to get from A to B. And they start taking steps in the right direction. Good for them! It’s rare.

But why is it so rare to have such clarity about what we want and how to get it?

Goal stoppers

When it comes to financial planning, we spend the vast majority of our days working with people to help them articulate their goals. It is very hard, and very rewarding work. Based on this experience, we can tell you what impedes the average person on their ‘goal’ journey.

The chat

While we may have notions of awesome family holidays, kitchen renos, private school fees, a new car, or a once-in-a-lifetime experience; it isn’t often we spend time really mapping these projects out. For most of us, while these aspirations sound great, we probably can’t do all of them at the same time. So how do you choose? You need to start by being really clear about your values.

Get started by understanding what you want your future to look like.

Download our guide: Paint Your Future.

Get help clarifying what is most important to you.

[ninja_form id=37]

What’s truly important to you? We ask our clients this and so often it is a really hard and awkward question to answer. It’s a question we don’t ask ourselves regularly, and one that very few couples ask of each other. Without clarity of the things you truly value, it is impossible to prioritise your goals. You also have to move past any reservations you have about talking about money.

Horizon

The longer out you are planning for, the harder it is to know what you want. Who knows exactly what they want to be doing in 15, 25 years time? Will you want to travel the world or spend time with grandkids? Will you want an awesome ‘drawcard’ home by the sea or to stay within the comfort of your family home and community? Do you think you’ll be ready to ‘downsize’ to a low-maintenance unit? Will you need extra health support? Who knows! But you can make some rough guesses. The closer you get to the ‘destination’ the more likely you are to know what you want. To build a great financial plan, you don’t actually need to know the minute details – so relax. You do however need to have a rough plan so you know what range of options you can expect down the track.

Lack of a plan

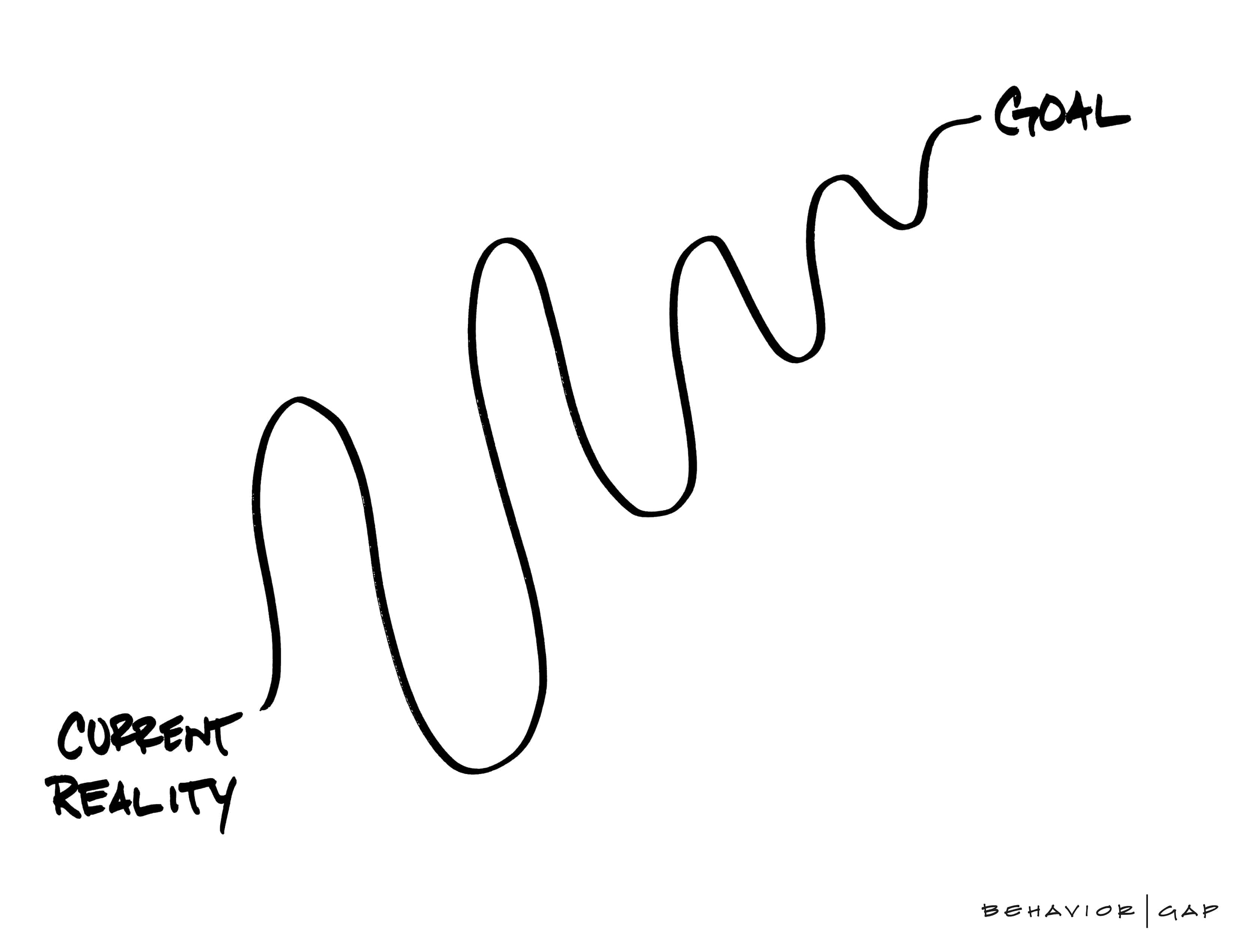

The fear of the unknown is a great motivator to put your head in the sand. Don’t fret – you are not alone! One of the more common admissions we hear from new clients is that they have been wanting to get their financial lives organised, but they didn’t know where to start. Just because a plan won’t be 100% right in 10 years time, doesn’t mean you shouldn’t have one. Regardless of what happens, those with a plan fair better than those without. Think of your financial plan like the bumper bars at the bowling alley. The ball may waver from side to side, but a plan will get you to the desired ‘strike’ eventually.

Conflicting ‘wants’

Once you start the conversation you may find that you have conflict in your list of ‘goals’ or ‘wants’. The tension can be between all that you want, and what you can afford. Or it may be between family members. Regardless of the tension, priorities need to be defined. Everyone needs to be comfortable with what they are ‘giving up’ in order to ‘get’.

Does it matter?

The surprising answer, coming from advisers, is not really. You don’t need to know with precision what exactly you want in 20 years’ time. You have permission to relax – just take a guess. That is the important part. Just start. Make some guesses.

Time to work

To get the ball rolling for your financial life, get clear on today – success is dependant on your ability to understand where you are and what your next steps need to be. Shorten the horizon, sure. But don’t take your foot off the pedal. Think about the next 12 months, 3 years. Then take some wild guesses about the future. This will put you in good stead.

Ignoring it all because it’s too hard is where 80%* of Australians fail themselves.

Map out the goals you do know about here.

You’re not alone

As professional advisers, we have seen it all and we are passionate about helping people move in the right direction. Not only can we help you clearly organise your current state of affairs, but we can help you start bringing a bit more clarity to those all-important future goals, I mean guesses.

Start the conversation

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

*20% of Australians seek financial advice.

Sources:

https://ritetag.com/hashtag-stats/lifegoals

Posted in Budgeting & Goals