Making more with the same

September 29th 2017 | Categories: Budgeting & Goals |

There’s plenty of ways you can make money from what you already have. A few examples include selling pre-loved items like furniture or clothes, using your knowledge to tutor, become an Uber driver or dog walker… and the list goes on and on.

But what if I told you that you could use your home to set yourself up for the future? What if I told you that you could produce wealth with the same amount of income you currently have? Would you be interested?

34.5% of Aussies have a mortgage. But how many are making the most of it?[i]

Debt recycling is a financial strategy that allows you to use your mortgage, the equity in your home and your current income to invest in an asset that will produce an income (like an investment fund, shares or property).

Get in touch to find out if debt recycling is suitable for you.

[ninja_form id=37]

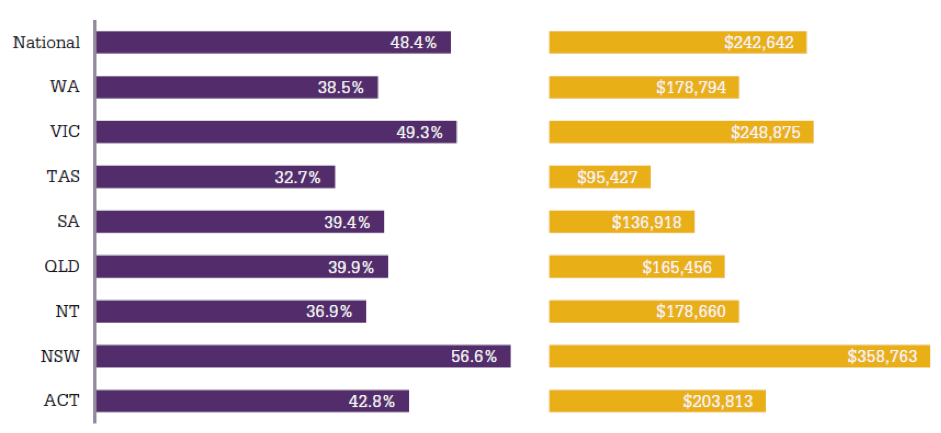

The climate of the Australian economy currently supports this strategy; interest rates are low, and property value growth is strong. The media commonly mention the challenges of housing affordability, but the truth is that because of strong property value growth, Aussie property owners with a mortgage have an average of 48.4% equity in their home.[ii]

Average level of home equity

Can you use your current situation to invest for the future?

Of course there are a few prerequisites:

- Do you have a mortgage?

- Is the value of your mortgage currently less than 80% of the value of your home?

- Do you have at least 20% equity in your home?

- Do you have time on your side – a long term investment focus?

- Do you have a consistent reliable income?

- Are you comfortable holding debt?

- Do you have the discipline and tolerance to invest consistently over time?

If you answered yes to all of the above, then debt recycling might just work for you.

How does it work?

As with most strategies, there are alternate options that allow you to increase growth and return. But the simplest form of debt recycling allows you to use your current income and mortgage to begin or build on wealth creation; we like to call it ‘doing more with the same’.

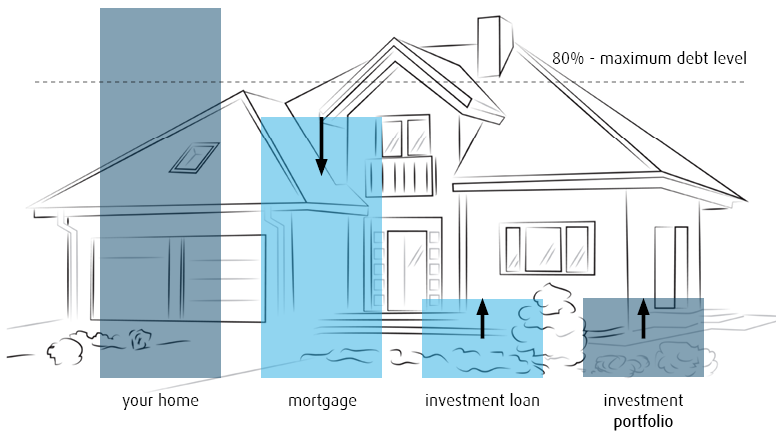

The structure of accounts and set up is different for each individual as its dependent on your risk tolerance, investment options and debt to equity ratio. But in basic terms, you continue to pay the same amount off your mortgage, you consistently take an amount out of an investment loan, and direct that amount into an investment portfolio. The value of the investment portfolio grows over time and the investment assets produce an income. The concept is based on the fundamental theories of investing; dollar cost averaging and compound interest, and creating tax inefficiencies with the use of good debt rather than bad debt.

Let’s face it, as good as it is to spring clean and sell a few unnecessary items, there are other ways you can use what you already have to build wealth and invest in your future.

[bs_button size=”block” type=”link” value=”Download our free introductory guide to debt recycling” href=”http://www.investblue.com.au/debt-recycling-lp”]

To learn more about debt recycling or other ways that you can achieve your dreams, get in touch with the team today.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

[i] http://www.abc.net.au/news/2017-06-27/home-ownership-rates-continue-to-plunge-census/8654534

[ii] https://propertyupdate.com.au/australians-own-more-equity-in-their-homes-than-you-think/

Posted in Budgeting & Goals