My partner is a spender – managing joint finances

February 3rd 2021 | Categories: Money, Family & Relationships |

It can feel like you’re losing an uphill battle, you make every effort to plan ahead or get on top of your debt and the next day your credit card is topped back up with an impulse purchase made by your other half or perhaps you’ve been saving away for a future goal like buying a home, but your partner won’t jump on-board and help contribute towards the savings.

These issues aren’t solely on savings either, there are a wide range of issues couples can face when combining both lives and finances. It’s important to keep in mind each relationship is unique and so is everyone’s financial journey and situation. We discuss common issues and how you may overcome these below.

Reasons couples fight over finances.

Managing your own finances can be hard enough, so it’s no surprise it can be a challenge trying to juggle finances as a couple. If you are feeling the stress of finances in your relationship know you are not alone, finances are the cause for 36.1% of divorces in Australia.

Managing Different Incomes

It’s common for couples to have varying incomes, where one partner may be earning a significant amount more than the other. There may also be periods where a partner is out of work altogether.

If you’re the sole provider or the one earning more it can be hard deciding what is fair and underlying resentment may build up over time.

There are different options you may choose depending on your situation:

Split 50/50: As simple as it sounds everything is split evenly, this may be suitable for those on similar incomes.

Split proportionally: For example, you may both put 50% of your wage into a joint account and leave the rest available for your purchases. This works well if you have large pay gaps.

Everything in: All your money goes into one account and can be accessed as needed, this is ideal for families, you may choose to keep a proportion aside for your own spending.

Itemised Expenses: One partner may pay for an expense such as the rent and the other pays for groceries and electricity.

Different money types & values

We can break down the way you treat and perceive money into 8 different money types, from spender, saver, gambler, avoider, flyer and so on. If you and your partner have different spending habits and values on money it can be hard understanding one another especially when you’re working towards a goal such as paying off debt. It’s important to understand both your own and your partner’s money type.

Having different values can also be challenging. For example, material items may be important to you, but your partner prefers experiences and living in the moment.

You can find out more about different money types here.

My partner has different goals or priorities

Goals are specific plans or objectives that people have in life, such as taking a fabulous vacation or saving for a home. It is important to recognise that people’s goals are often influenced by their money types and values. So, if your partner is a spender, it is unlikely your goal of starting an emergency fund will align with their financial goals. One of the biggest problems in having a partner who has different (or no) financial goals is that it’s very easy to slip into the same mindset.

Understanding what’s most important to you and outlining your goals are the first steps to living your dream life.

Control & Lack of Transparency

Another reason couples face tension with finances is when they feel there is a lack of transparency around finances or one partner is over controlling with financial matters. In some cases, this may lead to financial abuse or financial infidelity (hiding or being secretive about money).

Financial transparency is important in a relationship. You need to be able to trust your partner, just as they should be able to trust you. Discussing your financial experiences and financial journey can help you understand one another and why you have those habits and beliefs.

Debt

From student loans to car loans, credit cards to medical bills, most people begin their relationship with some form of debt. If you know your partner is a spender or you suspect that your partner is in debt, conversations around income, spending and debt may arise. Talking with your partner about their financial difficulties can be delicate and it’s important to approach the topic with empathy.

If your partner is in debt, you may take some solace in knowing that you are not legally responsible for their debt unless it is a joint debt, or you have acted as a guarantor. If you have joint finances, such as a mortgage or a joint bank account, then your credit rating will be affected if you partner defaults on their debts. So, if your partner has debt problems, it’s probably a good idea to avoid joint accounts. Even if you want to help your partner pay down their debts, keeping your finances separate will ensure at least one of you have a good credit rating.

If you or your partner are struggling with debt, check out our guide to managing debt here.

Steps to overcome financial issues with your partner

Have an open conversation

When it comes to money, communication is key. Determining your financial compatibility and financial goals as a couple can only start with one thing – a conversation. It doesn’t matter how long you have been together for, it’s never too late (or early) to start discussing money.

To get started, share your financial journey and financial experiences, discuss how you view money and why you view it that way. If you and your partner don’t know what your respective money situations are, you’ll have a nearly impossible time planning out your financial future. Sharing where you each stand financially provides a foundation in which you can create hypothetical scenarios about how to handle money as a couple.

If you and your partner have trouble talking about money, you can seek out the help of a Financial Adviser for unbiased advice.

[ninja_form id=37]

Share your goals

Next, discuss your goals with one another – are their goals compatible with yours? How can you work together to achieve your individual and shared goals?

It can be a useful exercise to write down your own financial goals and then share them. Some goals may be set for the short term, consisting of things you want in the next few weeks, months or within a year. Whilst other goals may be set for the long term such as saving for retirement or building an investment portfolio.

Financial goals (both long term and short term) should be SMART, meaning specific, measurable, attainable, realistic and timely. By working with your partner, you can determine what your specific goals are, how you will measure them, what you will both do to make these goals happen and how much time is needed to achieve these goals.

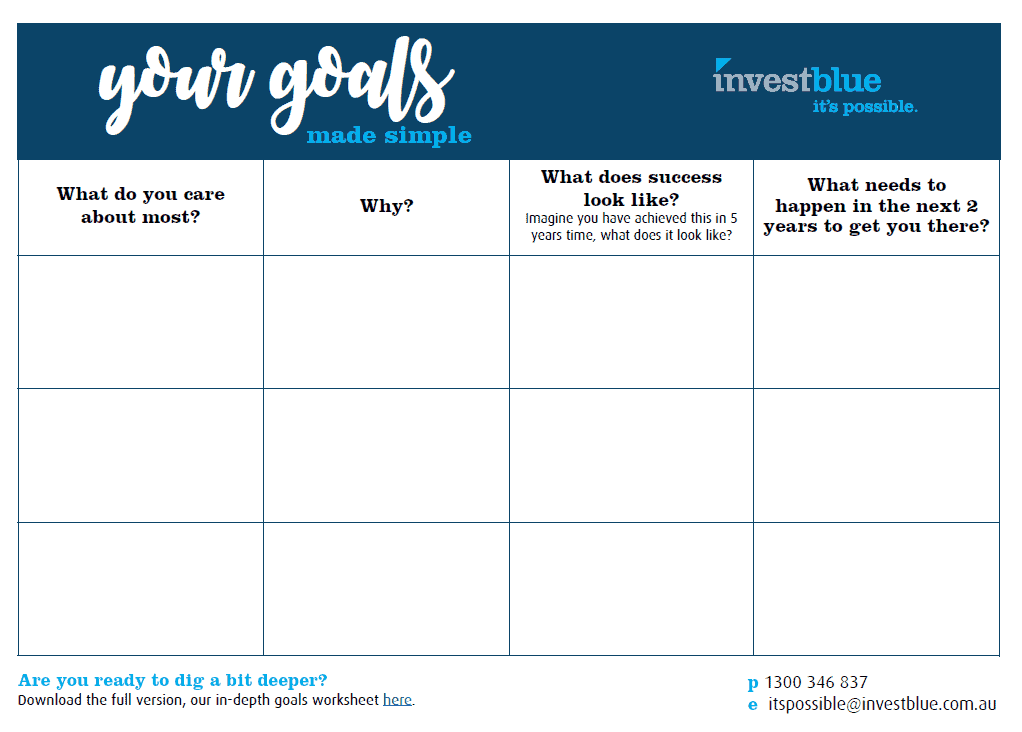

You can work through your goals, prioritise, and start to plan out how you will achieve them using our fun goals worksheet here.

Discuss a joint budget

If you live together, it could be beneficial to create a joint budget. One of the greatest sources of money stress is uncertainty. Not knowing where you stand financially can be a source of anxiety. By creating a joint budget, you and your partner can feel in control of money and ensure you’re working towards both of your financial goals. You can allocate money for upcoming bills and plan to save for shared goals such as paying down debt or saving for a holiday.

To create a joint budget, sit down with your partner (preferably with wine or good food) and go over the basics of budgeting. Joint budgets are made up of 3 key areas:

- What you earn (combined)

- What you spend (including expenses, debt and spending habits)

- Your shared financial goals

You can read our guide to budgeting here.

Compromise and create a plan

As a couple, creating a life together, it may be beneficial to come to a compromise, now you understand each other’s goals and budget you can compromise and find ways to work towards your joint and individual goals. If you know they are a spender perhaps they can set an allocated amount they spend on whatever they like a fortnight and another portion can go away into savings.

You can then map out what that looks like. What percentage of savings you want to put towards each goal, how long will it take? Setting review dates or goal benchmarks is a great way to track your progress and make any adjustments if necessary, along the way. It may also provide you with an opportunity to openly check in with your partner without feeling like your watching their every move.

If you need assistance in planning your financial goals as a couple, contact a Financial Adviser.

Create a pronup

Unlike a prenup, which is a contractual agreement determining what your legal and financial rights are in the case of divorce, a pronup is designed to see your relationship succeed without anticipating separation. A pronup is a personalised financial agreement made with you, your partner and your Financial Planner that will help you work towards your goals and dreams together.

You don’t have to be married to have a pronup! A pronup will work for any relationship regardless of what stage it’s at. With the guidance of your Financial Planner, the pronup will help you identify each other’s financial dreams and goals as well as have an open discussion around your financial position. You will then be presented with a joint financial plan giving you a holistic view of your finances and identify where you’re best investing your money for the future.

You can read more about pronup’s here.

Managing finances as a couple can have its challenges especially if your partner is a spender or you aren’t on the same page financially. The first step to have a conversation, create a manageable action plan to move forward and seek professional help if required.

Speak to us today about a pronup for you and your partner.

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Money, Family & Relationships