What is Financial Planning

July 21st 2022 | Categories: Value of advice |

Financial planning is much more than choosing products and investment funds. At Invest Blue financial planning it is about creating a plan that is designed to empower you to live your best possible life.

Financial planning all starts with a conversation about you, your values, goals and dreams. From there we can look into reviewing your current situation and look for opportunities to help you get ahead.

What Is A Financial Plan?

Australian Investments and Securities Commission (ASIC)* says a good financial plan should:

- Summarise your financial position.

- List your goals.

- Explain how you will reach those goals.

- Show how carefully chosen investments mesh together as working parts of your overall strategy.

- Disclose and explain any risks and how they can be overcome.

- State all the costs.

How We Can Help You

A Financial Planner from Invest Blue will help you build a plan that can:

- establish what is important to you – your goals.

- explain how you will reach those goals.

- ensure you make the most of superannuation.

- put the right wealth protection in place for you and your family.

- identify wealth creation opportunities and strategies.

- help minimise your debt.

- identify tax minimisation strategies.

- help you plan for your retirement.

You can read how we’ve helped some of our client’s here.

Explore our Knowledge Centre below for more insights.

Benefits Of Financial Planning

- A financial plan helps you construct your priorities and design the lifestyle that you desire.

- You will be able to manage your financial affairs by having an understanding of money.

- By sticking to your plan, you can avoid excessive spending and unmanageable debts.

- You will have a sense of freedom from financial worries that come from a lack of planning.

- You will be more effective in building, using and protecting your wealth throughout your life.

You may be interested in our articles

- How does a financial advice work?

- Ask an Adviser – what’s the point for a financial adviser

- Understanding your loan

- Mortgage vs Super – Where should I direct my surplus cashflow?

- Supercharge Your Retirement: Strategies for Boosting Your Super Balance

Your Financial Planning Journey With Invest Blue

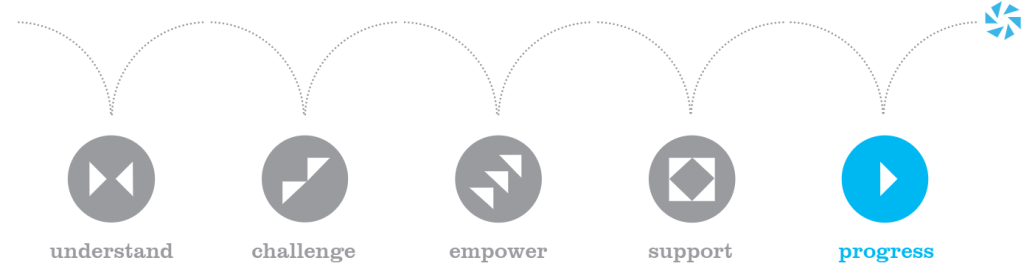

At Invest Blue we make the financial planning process enjoyable and easy working with you through a five-step process. You can learn more about our process here.

Not sure where to start? Try our Financial Health Check

Our financial health check will give you an overview of your current situation and identify any areas where you could be making improvements.

Book a chat with us if you would like to speak with one of our other financial advisers.

Want a Complimentary Consultation?

Fill in the form for a complimentary consultation with a Financial Adviser and start living your best possible life.

What you need to know: This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Posted in Value of advice