What value is there in a financial plan?

August 17th 2018 | Categories: Value of advice |

There are invaluable benefits in the process of creating and checking in on your financial plan year after year.

Traditional financial planning of years gone by was quite a stagnant affair. A client would come in, be expected to know exactly what they wanted for their future and then a plan would be set to get them there. There was a lot of ‘faith’ in this, on both parts. Faith that the market would do what it was supposed to do. Faith that the client wouldn’t change their mind.

It isn’t a coincidence that this type of advice traditionally appealed to those who were about to retire. The picture of the future was relatively known – as in, I would like to stop working in the next 2 years, what next?

As a Financial Planning practice, we know that there is so much more to offer people at younger stages of life. In fact, it is those who are starting to get into the ‘nitty gritty’ of their lives, with a family and career and 20-30 years of work ahead of them, where we can provide the most value.

[bs_button size=”block” type=”info” value=”What stage are you at on your journey?” href=”https://www.investblue.com.au/my-journey/” target=”_blank” ]

Let me take you on a journey of famous quotes about ‘planning’.

Let me take you on a journey of famous quotes about ‘planning’.

“A goal without a plan is just a wish.”

We make decisions every day that will impact our future – in the short, medium and long-term. So many of these choices are made subconsciously, and many are done on ‘gut instinct’ or made as a response to the way we are feeling at the time. Little things like grabbing a coffee from the shop down the road because you feel like a treat or an energy boost. Medium things like booking a holiday to Fiji because you need a break and are craving some down time with your family. Even big decisions can be made without fully understanding the long-term implications. Perhaps you have enrolled your children in private school without understanding how you will afford it in another 5 years’ time when their fees go up. Maybe you have decided to take a leap of faith, quitting your job to start your own business without knowing how that will impact your retirement savings. You may have committed to renovating the house, but not be sure if that means you will have to forgo travel for 5 years while you pay for it.

When you have a financial plan, these choices can be factored in. You can see what you can afford. You can make informed decisions about what you trade off. What happens now, and what can wait. What matters to you most, and what is just a ‘nice to have’.

The hard part about all that, of course, is that when the plan is built we all make a bunch of assumptions. An adviser assumes you know exactly what you want now, next year, in five years, in twenty years….and that you can put a value on that. A client assumes that the adviser can predict investment returns, economic policy, and global events. That’s asking both of us more than we ask of the evening weather report! Of course, you don’t know exactly what you want. And no one can predict with precision what a dollar today will be worth in 25 years’ time.

“If the plan doesn’t work, change the plan, but never the goal”

Therein lies the magic of PLANNING. When we sit down with a client, the first place to start is to help that client articulate their values – what is most important to them, what do they want their money to do for them. This first step is HUGE. It is often a really hard question to answer because few of us ever really think about it. But it is a critical step. When we know what is most important, we are then prepared to challenge goals and ensure that plans stay true to a client’s values over the years to come.

When we move on to understanding the goals and objectives our clients have, we aren’t looking for 100% precision, but we are wanting to make good guesses as to what they hope to achieve. So, if you are not crystal clear on what you want your future to look like, that is ok. Just make a few guesses.

It is likely that you will have stronger clarity on the things you are after in the next year or two. When we meet with you in subsequent meetings, we will review how you are tracking to those short-term goals, as well as check in on our longer-term guesses. We use a tool to model out your financial life in line with your objectives to see if you are on track. If not, we revise the plan.

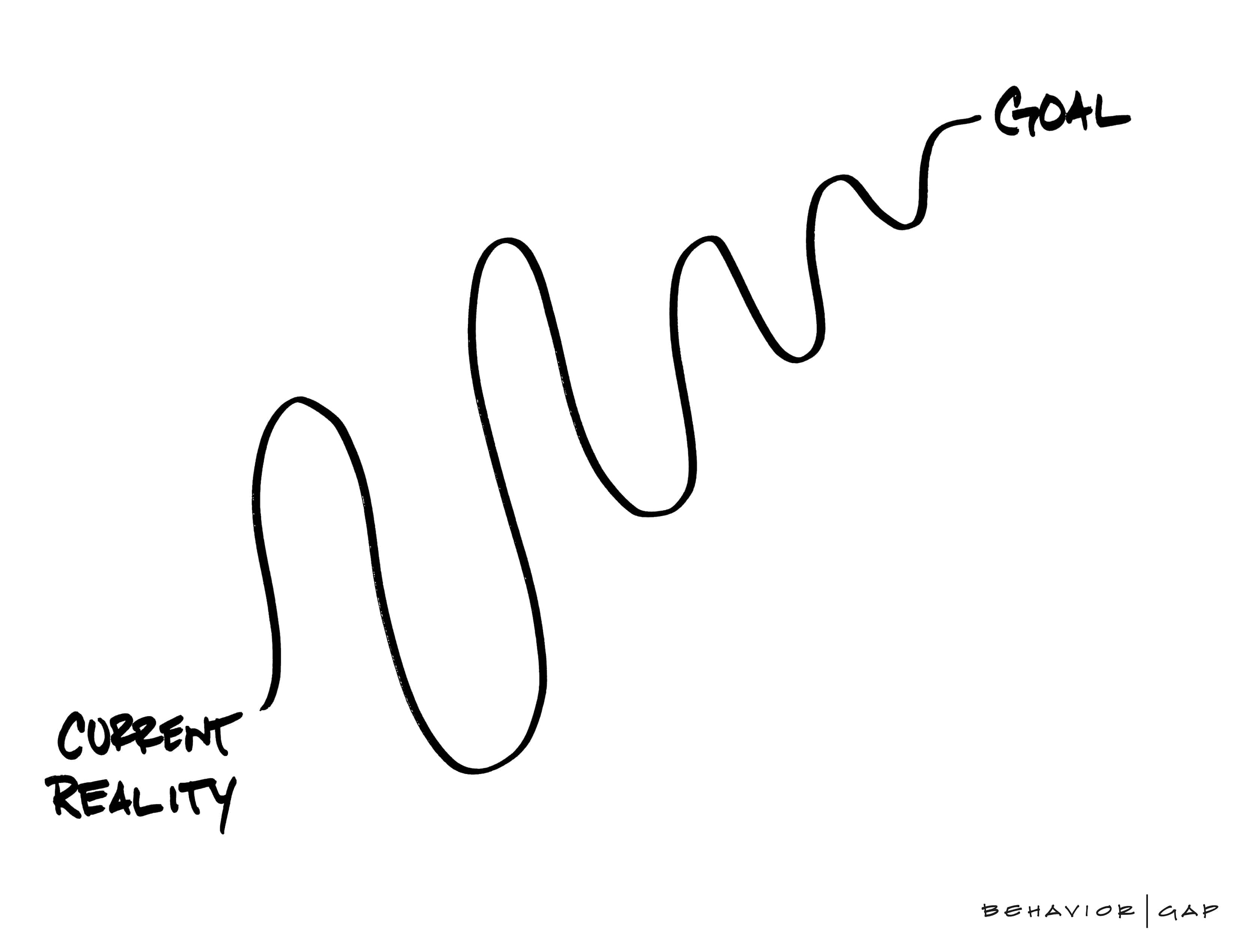

Planning year in and year out keeps us within a range of our goals.

“Unless commitment is made, there are only promises and hopes…but no plans.” Peter Drucker

This is where you come in. We can give you 100% clarity on where you are at today. We can also help you clarify what you want in the future. From that, we make recommendations on strategies that will give you the best chance of achieving your goals. Then it is up to you.

The benefits of having a detailed plan are that you understand the impact of your choices. It also gives clarity and confidence to you and your family. This clarity can be a great pressure release if you are in a relationship with someone who has a different view of money (which most couples do). With a plan that meets everyone’s objectives, everyone knows what to do, or not do.

If you find that you are not able to commit to the plan, there could be a very good reason. Perhaps we haven’t articulated your values properly. Your plan may be focused on a long-term goal when you are living with a more short-term view. Your circumstances may have changed. There are lots of reasons, but the good news is that once you have a plan and someone on your team helping you with it, you have someone there for you. There to hold you to account. There to help you figure things out when life changes.

“Life is what happens while you are busy making other plans.” John Lennon

Which brings me to my next point, life will change, without question. Financial planning is not a ‘set and forget’ practice. It is something you need to check in on regularly. Some of the main risks we see people exposed to when they don’t have a regular planning session is:

- Your financial exposure increases, but your cover doesn’t. Think pay rises, higher mortgages, children. Then think about what would happen if you couldn’t work. It may seem like an unlikely situation, but it is estimated that 1 in 4 of us will have an event in our life that Personal Protection Insurance would potentially cover.

- Current savings plans are not adequate to fund an increasingly longer retirement period.

- Opportunities to get ahead are not being taken advantage of – people are working hard and spinning their wheels on the wealth track.

- Opportunities to enjoy life now are being forgone due to worry about the future – ignorance about your situation and fear of the unknown leaves many hoarding savings when they could be safely spending a bit more each year on the things that are most important to them.

“Plans are nothing; planning is everything.” Dwight D. Eisenhower

We can’t be 100% certain about the future. But we can make some intelligent and informed guesses. “Goals are guesses” We can take an accurate snapshot of today. The process of doing this year in and year out means that we get better at it. We learn more about who we are, how we behave and what is happening around us.

Without a plan you are exposed to uncertainty and unnecessary risk. Whilst the plan we build today may not eventuate precisely; you can be sure you will be better off with it than without.

So why bother?

There is a reason we are not great at planning ahead: it feels like a lot of work, we have to make decisions based on ‘best-guesses’ or assumptions, we don’t have all the answers, it forces us to make choices we may not want to face and it can be really hard to do all on our own.

We fully recognise that plans themselves have a short usefulness window, but the process of planning is absolutely without a doubt of incredible value.

What are the consequences of living without a plan?

What are the consequences of living without a plan?

What’s your plan? Get in touch.

[ninja_form id=41]

Drawings provided by Carl Richards, author of the Behaviour Gap, Financial Planner and International Public Speaker.

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Value of advice