Why financial advice has never been more important

August 13th 2020 | Categories: Value of advice | Financial Planning |

One of the main reason’s Australians seeks advice is that they are ready to create and implement change in their life. This could be a change in their life stage like wanting to buy a new home, marriage or divorce, or getting ready for retirement. We can often control when these types of change occur.

However, what about the changes that we can’t control? The unexpected? For instance, the current global pandemic, significant economic events or an injury or illness. Often we can’t control when these changes occur, but we can be prepared for them in case they do.

In this article, we look at why financial advice is more important now than ever;

Are you looking towards the future however aren’t sure how to finance it? Talk to us today about how to structure a financial plan that starts with your dreams and goals.

[ninja_form id=37]

Advice when it matters

If there’s anything 2020 has taught us it is that we can never predict what’s around the corner. Although we all like to feel in control of our lives, we all know that change is inevitable, so in fact, can in many ways be prepared for. For example, the economic crises we see globally is being described as a ‘black swan’ event. Something significant and entirely unpredictable. Except that it is. We don’t know when these ‘black swans’ will turn up, but we do know that they will.

During this period, you may be experiencing financial change, whether through changes to your household income or changes in the value of your investments. During this time financial advice has never been more important and as Advisers, we play an important role in protecting the wealth of our clients during this time, as well as helping those who have been impacted better position themselves.

How we can help during these times of uncertainty:

- Reset: get a clear picture of where you are now

- Refocus: help you redefine your best life by clarifying what is most important to you and prioritising your goals

- Regroup: create your new financial game plan in tune with you and your life:

- Help you manage changes in cash flow and budget accordingly

- Review & potentially restructure investments portfolio

- Point out opportunities you may not have noticed such as leveraging home equity

- Review your super and potentially restructure

- Help you obtain full benefit entitlements e.g government benefits and insurance claims.

- Help you determine when to buy and sell and investment

- Relax: That may seem like a stretch, but the greatest cause of stress is uncertainty. By getting everything out in the open and showing you what your future looks like, we take that ambiguity away. This is the only way to provide you with confidence & peace of mind around your finances

A good financial plan always considers your exposure to risk and strategies are implemented from the very beginning to help you ride through these changes.

“I doubted very much that I could ever get my finances back on track, but Adam came up with a plan one week after our initial meeting, which we’ve stuck to, and the results have been nothing short of extraordinary” says Belinda

How we protect your wealth

At Invest Blue, we take the responsibility and trust given to us by our clients in helping them to manage their wealth very seriously. Our clients give us the responsibility of protecting and enhancing their wealth and as such, we take a risk-based approach to the way we manage money. We aim to maximise the probability of our clients meeting their goals, whilst ensuring we implement a strategy that is consistent with their tolerance towards risk.

We do this by carefully reviewing the following:

Risk analysis:

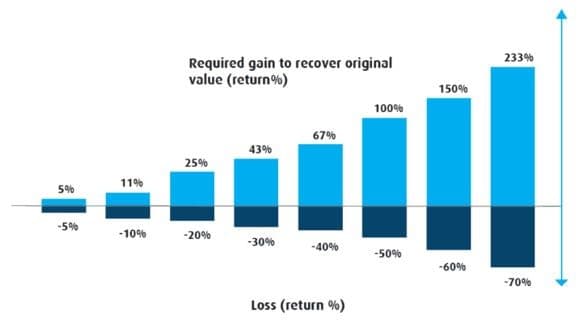

From your very first meeting we get to understand you, your goals and your lifestyle we also dig deeper and get an understanding of your risk tolerance when it comes to your investments. We find out how comfortable you feel about loss vs return and can match your wealth to a solution that matches that. We also believe in making sure our clients are exposed to the right amount of risk, based on their personal situation. Investors want ‘return on their investment’, however, to seek a return to meet your goals, you have to take on an element of risk. This trade-off is an import discussion in any wealth-building exercise.

“Having had such a fantastic working history with this organisation over so many decades, I was at my lowest ebb when my position ceased.

It was quite the turning point, we needed a plan put in place to financially secure our future years, and Tim provided us with various comprehensive options that really put our minds at ease.”

Read their full story here.

Long term investments:

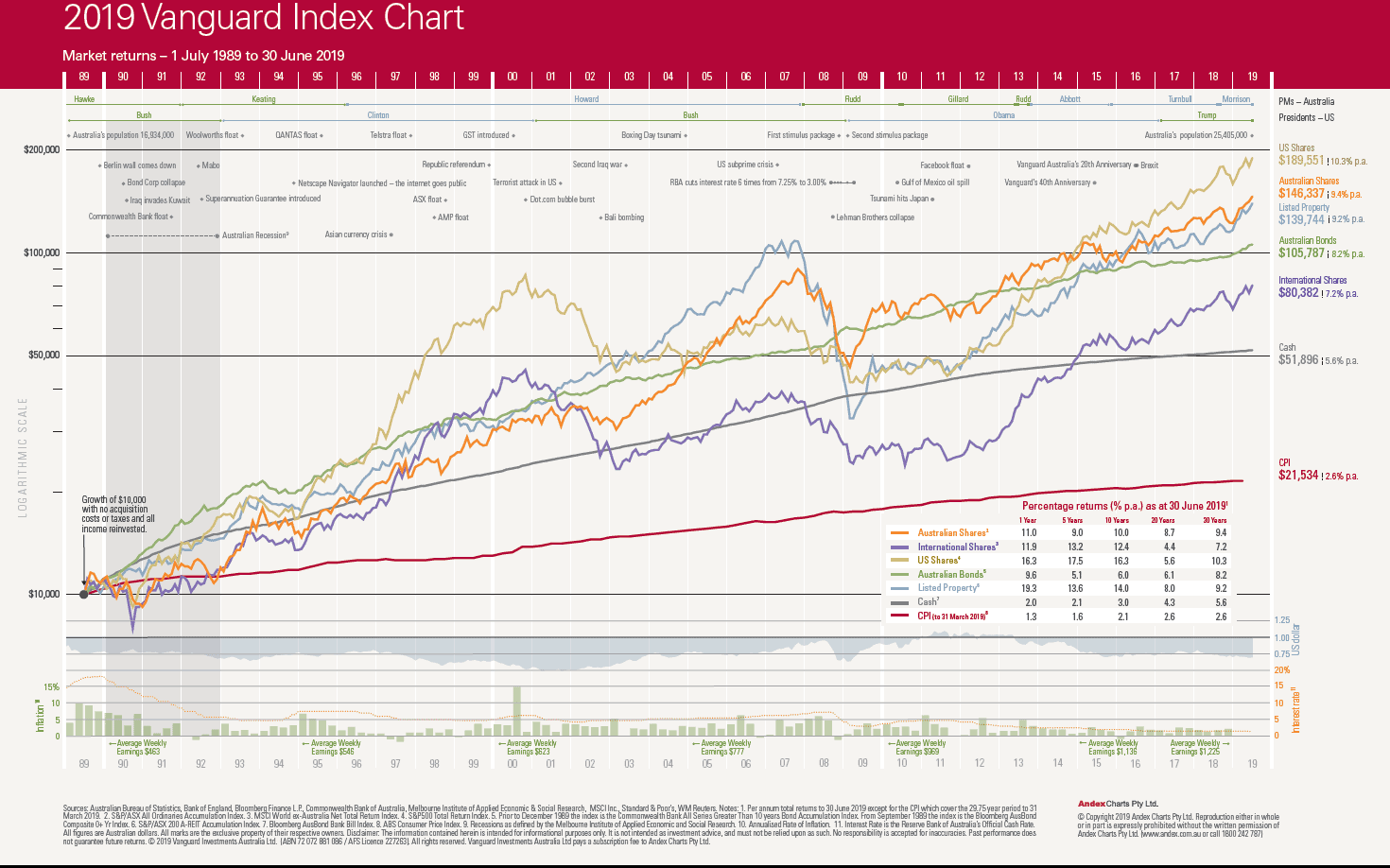

Having a long-term investment strategy is key to riding out changes in market values. We have all heard how quickly the stock market can rise and fall, however gradually overtime values have trended upwards. The length of time in which you choose to invest will help determine which kind of investment is right for you, whether it be property, shares, bonds etc.

You can read more on this in our market update “why super and growth assets like shares need to be seen as long-term investments”

Learn more about how we help our clients to grow their wealth.

Insurance:

Insurance quietly sits in the background until the day comes that you need it most. Having the right insurance in place to protect you at the right stage in your life is essential to ensure you maximise the value of your insurance and avoid paying unnecessary fees. You can read our wealth protection philosophy here.

We are passionate about ensuring that the things which are most important to you and the goals you have set can still be achieved in the event of unforeseen circumstances, including serious illness, death, temporary or permanent disablement.

Regular Progress Meetings:

Catching up with each other at least once a year ensures that when change does occur, we are able to reassess every aspect of your financial plan and ensure it is working in your best interest. Learn more about the journey our clients take when working with us. Even without global pandemics and wide-spread recession threats; life happens, and your personal life will change. It is critical that your financial plans keep pace with your circumstances, dreams and goals, and the world around us all.

For example, when approaching retirement your super portfolio should be reviewed to minimise your exposure to loss to help ensure you have the funds available when the time comes that you need to access them.

What not to worry about:

There is so much to be concerned about right now, but when it comes to working with us, here is what you should not be worried about:

- Your current situation: don’t be afraid or embarrassed, we all live different lives, we all have different priorities. What your situation looks like today will not shock or surprise us.

- Knowing exactly what you want: the process we will take you through helps explain all your options and the impacts of making the choices available.

- Being a united front: we work with couples all the time and can guarantee we will ask you questions that you have not yet considered yourself, never mind discussed together. The process of advice is an exploration. Each person will have the space to put forth their views and the plan we develop will reflect that.

- Being forced into a decision you are not comfortable with: our whole process is designed around you. We have a full range of options available to be tailored to your life and what you want. The process is not quick, it usually takes a few months at least to work through things. You will have time, information and plenty of opportunity to ask questions and challenge recommendations.

- Travelling or visiting on-site: if you would prefer, we can conduct our meetings over video conference.

- Commitment: we meet with everyone at no cost in our first meeting because we all need to get to know each other and see if the fit is right.

- Affordability: if we don’t think we can add value to your life, we will not proceed. Any fees we charge will be discussed upfront and explained thoroughly. Learn more about our pricing.

Wondering what a first meeting looks like? We explain what to expect here.

With wealth protection being equally as important as wealth growth, is the perfect time to partner up with an expert and map out your financial roadmap towards your best possible life.

If you’re serious about taking your finances to the next level speak with one of our advisers to find out how we can help you reach your goals and dreams!

[ninja_form id=41]

What you need to know

This information is provided by Invest Blue Pty Ltd (ABN 91 100 874 744). The information contained in this article is of general nature only and does not take into account the objectives, financial situation or needs of any particular person. Therefore, before making any decision, you should consider the appropriateness of the advice with regards to those matters and seek personal financial, tax and/or legal advice prior to acting on this information. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relations to products and services provided to you.

Posted in Value of advice, Financial Planning